The United States’ annual real gross domestic product (GDP) is expected to grow by 3 percent, while inflation (as measured by the US Urban Consumers CPI) to average around 2.5 percent, according to the latest report from DBS Group Research.

Surveys of businesses show both uncertainty about the outlook and the beginning of a trend of earnings projections being revised downward (starting with automobile manufacturers). But there are broader, still-supportive dynamics at play.

Last year’s tax cut will act as a shock absorber to potential downside from tariff wars, consumer spending is healthy, labour market is tight, fiscal stance is growth supportive, and trade, despite the poor headlines, is still robust, the report added.

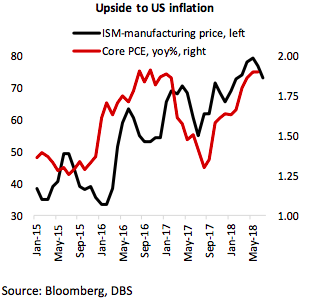

This path of economic data would not only ensure that the US Federal Reserve hikes two more times this year, but a continuation of the quarterly rate hikes can be expected next year as well. Inflation upside is likely (especially if trade wars continue and US-Iran conflict takes place), but so far the markers are modest, causing no heightening of concern for Fed policy.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment