US Treasury yields have rebounded over the past few weeks, as worries about the US-China trade war and the outlook for the global economy have eased somewhat. But while they are not expected to revisit their lows, Treasury yields are also unlikely to rise much further over the next couple of years, according to the latest research report from Capital Economics.

Since falling within touching distance of its all-time low in early September, the 10-year Treasury yield has risen by about 30bp, to 1.75 percent. This rebound reflects mainly rising optimism about the US-China trade negotiations, which has led investors to pare back their expectations for further Fed policy loosening.

In addition, the improvement in risk sentiment has reduced demand for safe havens – gold and the yen have fallen by 5 percent and 2 percent, respectively, over the same period. Investors’ fears about deflationary risks also appear to have eased a bit – the inflation compensation implied by 10-year TIPS has risen by about 10bp.

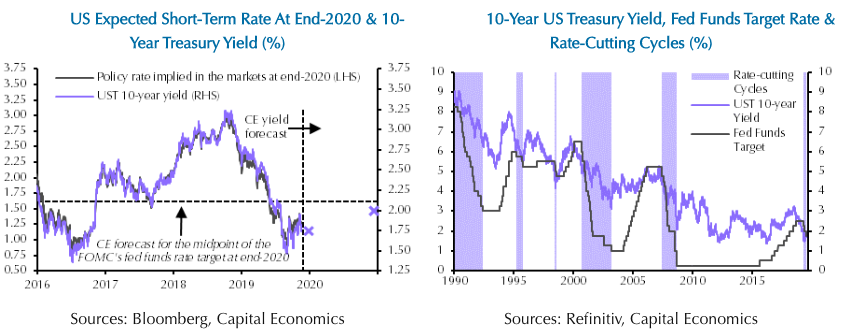

Bond yields had fallen too far in September, because the economy was seen as slowing rather than falling off a cliff and that the Fed would not deliver as much easing as investors anticipated (at the time, the fed futures market implied an expected short-term rate of 0.75-1 percent by the end of 2020.)

Today, the market has largely come around to that view; investors do not expect further easing from the Fed in the next few months and discount only one more 25bp cut by the end of next year, which would take the Fed’s target band to 1.25-1.5 percent, the report added.

While the Fed is more likely to keep interest rates on hold, there is no longer a major difference between Capital Economics’ forecast and investors’ expectations. The report forecasts that the Fed policy is consistent with the 10-year yield rising only slightly in 2020.

The 10-year Treasury yield has tended to bottom out around the end of the Fed’s easing cycle. This suggests that, if we are right that the Fed will remain on hold from here, it is unlikely that the Treasury yield will revisit its September low, unless there is another severe bout of risk aversion or a major shift in policy.

"At the same time, although we think that the US economy will turn the corner in the first half of 2020, we also don’t expect it to rebound strongly thereafter. Instead, we anticipate mediocre growth and subdued inflation over the next few years, in both the US and the rest of the global economy. In that environment, it is unlikely that the Fed will start tightening policy anytime soon," Capital Economics further commented in the report.

Meanwhile, the upshot is that the 10-year Treasury yield is not expected to rise much further, and we now forecast it to stay around 2 percent for the next couple of years. While that is low by historical standards, it is in line with the downward trend over the past three decades, during which both inflation and real economic growth, and therefore the ‘neutral’ interest rate required to keep the economy in balance, have fallen.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022