The first set of UK's hard data from the post-referendum period do not show any major impact from Brexit yet and hence is likely to keep the Bank of England (BoE) on hold at its September 15 meeting.

A survey by financial data firm Markit showed on Wednesday that British households have recovered from a loss of confidence about their finances. Markit said it’s Household Finance Index for August reversed July's plunge and edged above its level in June at 44.9, the highest reading in four months. The survey showed concern about job security also eased in August after reaching its highest level in three years in July.

"Concerns seem to have eased in line with the removal of some of the immediate political uncertainty arising from the shock referendum result, combined with a strong monetary policy response from the Bank of England aimed to cushion the economy and head off any lurch towards recession," said Jack Kennedy, senior economist at Markit.

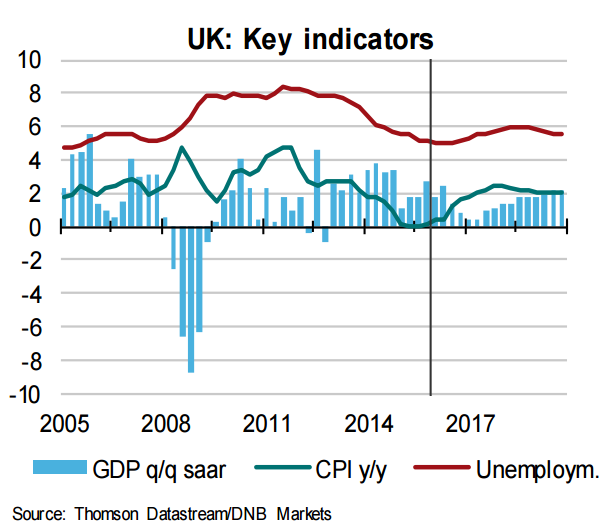

Separate data released by the Office for National Statistics (ONS) on Wednesday showed the UK’s official jobless rate remained unchanged at eight-year lows of 4.9 percent in July, while the claimant count surprised markets on the downside. UK claimant count unexpectedly fell by a seasonally adjusted 8,600 in July, compared to expectations for an increase of 9,500 people. The unexpected dip in claimant count in July showed that UK job market has not been dented in the immediate aftermath of Brexit.

The unemployment data follows Tuesday’s inflation update which showed UK's consumer prices index (CPI) rose to a higher-than-expected 0.6 percent in July (consensus 0.5 percent). There was no obvious impact from Brexit, but it’s probably too early to spot signs of Brexit damage. The pound is down by more than 12 percent since the EU referendum and it will be some time before the full effect of the fall in sterling feeds into the headline inflation rate. A weaker pound will cause inflation to rise more sharply in the coming months and may make it harder for the BoE to cut interest rates.

“While this is the first real sector data point that captures the impact of the Brexit vote, readings simply don’t show much impact yet. Inflation readings reported yesterday were muted. The next BOE meeting is September 15, and the lack of much new economic information should keep it on hold then,” said research team at BBH.

GBP/USD largely muted on the day as markets await FOMC minutes for clues on Fed rate hike path which is likely to have a major impact on the major. Cable was trading around 1.3015 levels at 11:30 GMT, down 0.22 pct on the day.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk