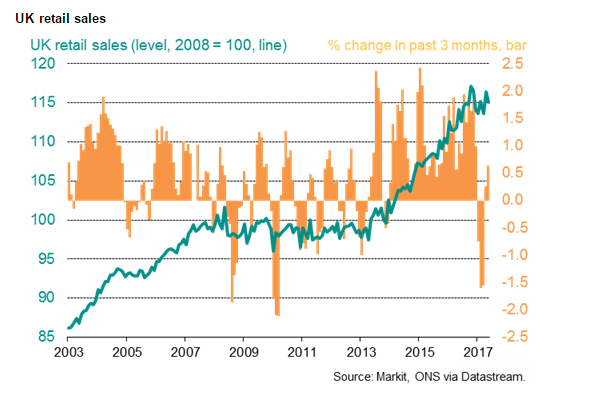

According to data released by The Office for National Statistics, the annual rate of growth in UK retail sales slipped to 0.9 percent, the lowest since April 2013. After a stronger than anticipated April retail sales on account of the timing of Easter, a more modest outcome for May was expected by most of the industry. But today's data was worse than expected and has raised warning signals for household consumption.

Retail sale volumes fell 1.2 percent m/m in May, worse than the 0.8 percent decline economists had expected and followed a 2.5 percent jump in the index in April. The main contributors to the retail sales fall in May were non-food stores, where the annual volume of sales fell 1.2 percent. Annual volume growth in food stores was just 0.1 percent, the weakest since July 2013.

Retail sales, which make up around 20 percent of the overall GDP, are considered a crucial barometer for the health of the economy. Most economists said the prospects for retail sales growth beyond this quarter were bleak. That said, the strong April still means second quarter sales are so far running 1.4 percent higher than the first quarter on average, and are likely to make a positive contribution to GDP in the second quarter after dragging in Q1.

"Clearly, the impact of the fall in the pound on prices is weighing heavily on spending volumes growth. And this week’s inflation and labour market figures showed that the squeeze on real earnings growth is intensifying," said Scott Bowman, economist at Capital Economics.

UK consumer prices are rising at an annual pace of 2.9 percent and regular pay is growing at a rate of just 1.7 percent. Real (inflation adjusted) pay is now falling at an annual rate of 0.6 percent, which is the steepest decline seen since 2014. The hurdle to consumer-led growth keeps rising as increasing inflationary pressures cap household purchasing power. Looking ahead, further increase in costs likely from sterling’s substantial post-referendum depreciation.

The Bank of England's (BoE) Monetary Policy Committee held rates unchanged as expected. But a deeper split emerged among its committee of policymakers, with three of the eight voting for an immediate rate rise to keep inflation in check. Looking ahead, key considerations in judging the appropriate stance in monetary policy are the evolution of inflationary pressures, the persistence of weaker consumption and the degree to which it is offset by other components of demand, the central bank said.

Pound spikes after BoE decision showed Monetary Policy Committee came its closest to voting for a rate rise since 2007. GBP/USD spiked from lows of 1.2693 to 1.2795 levels. FxWirePro's Hourly GBP Spot Index was at -82.2827 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks