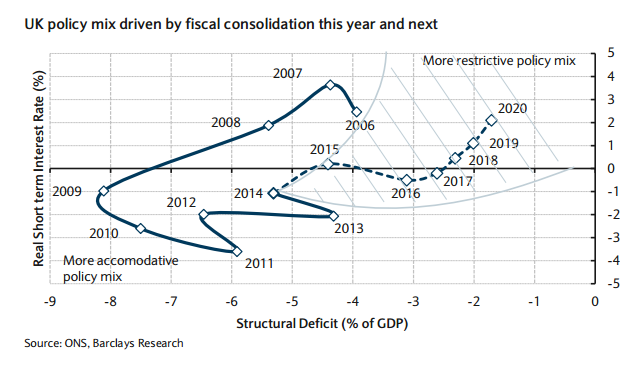

In terms of fiscal policy, we have aligned our forecast with the government's plans but only for the first two years (structural consolidation of 0.9% and 1.3% of GDP in 2015-16 and 2016-17, respectively) as we believe that fiscal consolidation will have to be eased after that to prevent an excessive slowdown in activity. By doing so, the government would replicate the pattern seen over the past five years, where initial plans were adjusted mid-way through in order to allow for growth to recover, and books will not be balanced by 2018-19 even though the debt to GDP ratio is to decline from 2016-17 onwards, says Barclays.

Still, over the next two years, fiscal consolidation will be material and predominantly affect areas such as tax credits, housing benefits, operating expenditure and defence spending. But that will likely not be enough and the government will have to hope for higher wages to boost income tax as well as deliver on promises to close loopholes and fight tax avoidance.

Accordingly, the Bank of England will have limited opportunity in the short run to hike rates "normally" as the policy mix will remain dominated by fiscal policies. However, given its confident forecasts showing growth above trend and inflation overshooting its target during the course of 2017, the Bank could hike in Q1 16, initiating an unprecedentedly gradual rate cycle of about 25bp every six months. During the first steps of the hiking cycle, the stance of the BoE in real terms might not even materially change as recovering inflation will keep real interest rates low.

MPC member comments in recent weeks have been generally constructive and have led the market to bring forward the date of the expected first hike from mid-2016 to Q1 16. Generally perceived as dovish, David Miles surprised the market by suggesting that a rate hike is coming "soon". More interestingly, he attached "more weight to the risks of waiting too long and then not being able to take a gradual path"; this contradicts the view that the BoE would rather be too late than too soon, but then again, Mr Miles's term as MPC member will end on 31 August.

In a speech on Thursday, Governor Carney said that "the decision as to when to start such a process of adjustment will likely come into sharper relief around the turn of this year" as the drop out of the annual inflation rate of negative base effects due to oil prices will make the firming of the economy more apparent.

UK policy mix to be dominated by fiscal policies

Thursday, July 23, 2015 1:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX