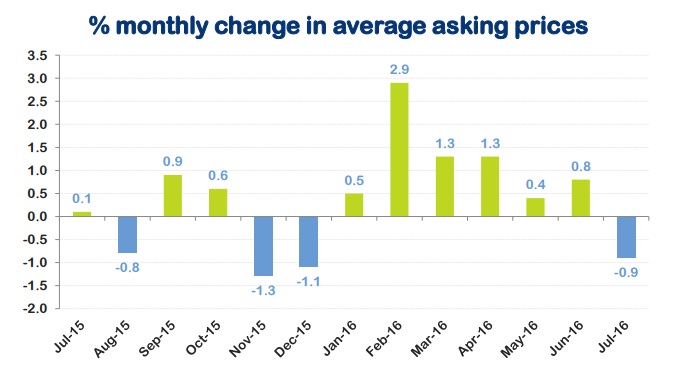

The price of the properties coming to the market for sale has declined by 0.9 percent in July, which means a decline of £2,647. A decline was well within expectations but it is important to note that current decline is still within a broad range, there is nothing dramatic, shocking or devastating in the numbers for the month, despite the fact that Britons voted to exit the European in the June referendum. The buyer enquiries are down by 16 percent in July but it is important to consider that July 2015 was a month of optimism after an outright victory by the conservative party.

Miles Shipside, Rightmove director and housing market analyst comments: “As far as the price of property coming to market is concerned, the fall of 0.9% is within the range that we have seen at this time of year since 2010. With the onset of the summer holiday season new sellers typically price more conservatively and the average drop in the month of July is 0.4% over the last six years. Perhaps unsurprisingly this July’s fall is marginally larger, as political turbulence has a track record of unsettling sentiment. Indeed last year saw a seasonally unusual 0.1% fall in the run-up to the May election, and a June and July price surge as a result of the post-election boost. Average new seller asking prices were up by 3.1% over that two-month period.”

The number of properties available in the market for sale is up, 6 percent higher than last year after the Brexit vote; however, it was down 8 percent in two weeks before the referendum. Even these numbers aren’t really the shocking ones.

It can be concluded that as of now there are no signs pointing to a shock sell in the market, on the contrary, signs have emerged that UK property prices remain steady. So it won’t be until another 6 months before any impact in the market can be gauged.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX