Two divergent central banks are creating havoc in the bond world that provides queues to future expectation and market movements.

- Today European Central Bank (ECB) starts off with its massive open ended purchase programme of € 60 billion per month.

- Improving economic dockets in the US are fuelling rate hike bet on US dollar. Most probable date is June 2015.

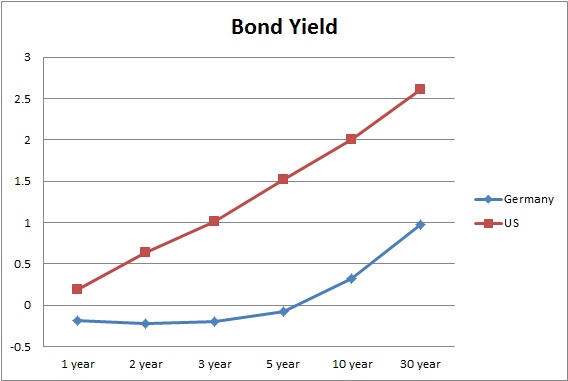

- Bund yields have fallen a lot against that of treasuries' which might lead to further Euro weakness. Longer maturity portfolios can yield a better return from carry trades between the pair. If the yields improve further in the US the carry trade could get more boosts.

- In the short run as the prices of the treasuries fall in anticipation of a rate hike, the bunds could provide further capital appreciation over the longer maturities.

- So far the shorter end of the curve have fallen further apart however if the Federal Reserve succeed in pushing the inflation expectation, the same could be in store for long end too.

Euro might start feeling further pressure once the actual balance sheet of ECB starts increasing. Euro is currently trading at 1.1218 against the dollar, well within its range of 1.11-1.127.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand