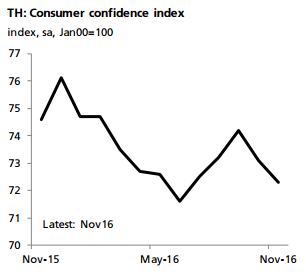

Private consumption in Thailand is expected to be stuck in the 3-3.5 percent range for a lot longer than most expect. The recent slide in the consumer confidence index is another sign that households remain cautious going into 2017.

It is tough to see private consumption growth back to its 4 percent potential. Nominal wage growth has slipped back to sub-1 percent in 4Q16, compared to an average of 2 percent in the first three-quarters of the year. Given that inflation has already returned to the positive, this means that real wage growth is flat going into 2017. Until we get stronger investment / export growth, weak wage growth is likely to persist, DBS reported.

At the very least, however, consumption growth is no longer falling. Positive spillovers from the government’s pump-priming are likely to pull up consumption demand, particularly in the rural areas. Besides, the slight recovery in the agriculture sector should also help.

Meanwhile, the sector grew 1 percent y/y in 3Q16, a modest turnaround after contracting by 1.3 percent and 3.8 percent in 1H16 and 2015 respectively. If sustained, even a marginal 1 percent growth in the agriculture sector may make a decent difference, noting that the sector employs one-third of the labor force, the report added.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out