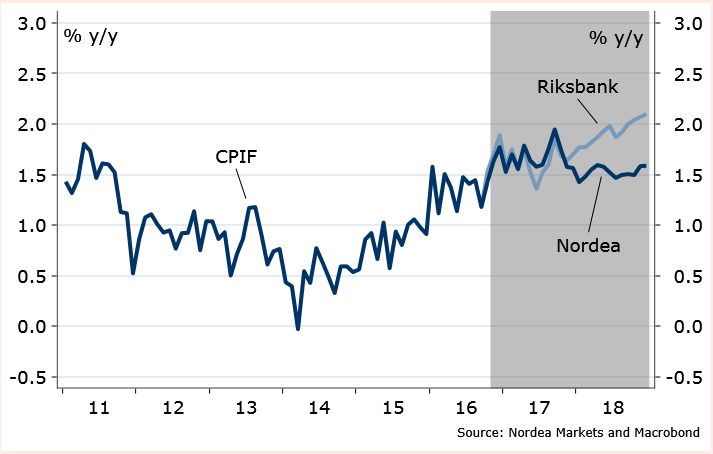

Sweden’s consumer price inflation is likely to have accelerated in November in sequential terms. According to a Nordea Bank research report the CPI index is set to have risen 0.1 percent, whereas the CPIF is likely to have come out at 1.6 percent year-on-year that is 0.1 percentage point below Riksbank’s forecast. Risks are skewed towards the downside.

November inflation is likely to have been driven by travelling prices. The seasonal pattern signifies that prices declined in November. But the fall is expected to have been less than normal as most of the autumn break was in November in 2016. Furthermore, Statistics Sweden changed method in 2016, gauging prices for foreign travelling more evenly over the month. This suggests that the rises in prices during the start of the month might impact the CPI.

“Our call is that prices for foreign travelling shaved off 0.1 percent point in November, compared to -0.3 percent point in the same month last year”, added Nordea Bank.

Meanwhile, food prices continued to increase slightly whereas prices for footwear and clothing are expected to have been largely unchanged. Prices of fuel and electricity moved in opposite directions, nearly balancing each other. Noticeably, both trends have been reversed so far in December, with fuel prices increasing but electricity declining, said Nordea Bank.

FxWirePro's Hourly EUR Spot Index was at -142.929 (Highly bearish), and Hourly USD Spot Index was at 114.508 (Highly bullish) at 1300 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility