The Federal Reserve's recent rate hike decision caused the U.S. interest rate to be higher than global interest rate, and thereby the economy is receiving more capital inflows.

The economy recorded a marginal fall in net trade, which is mainly because of weaker global demand. If the expansionary monetary policy adopted by Europe, China, and Japan boosts the domestic demand, the U.S. will be a beneficiary. This is because, most of the global trades take place in USD only. Therefore, there is further scope for USD to increase.

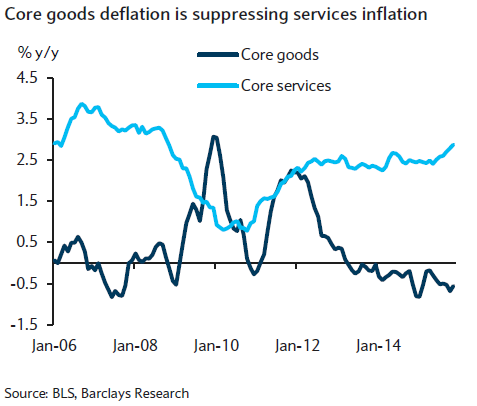

"We expect further pass-through from dollar appreciation to weigh on core goods prices through mid-2016. Renewed strength in the dollar since mid-year, particularly against EM currencies, and an accelerated decline in China PPI lead us to project a modest softening in core inflation in the months ahead - a factor which informs our believe that the Fed will execute three additional rate increases in 2016 instead of the expected four", says Barclays in a research note.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence