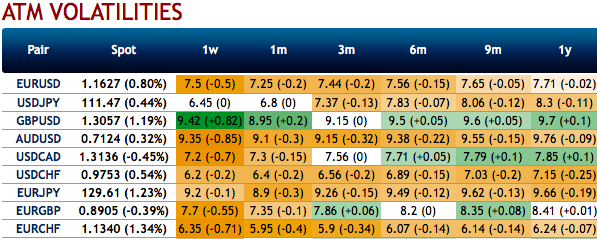

OTC indications: At EURGBP spot reference levels: 0.8905 levels, please be noted that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM call strikes upto 0.94 levels (refer above nutshell evidencing IV skews).

The highest number of trades of standard GBP option contracts are taking place in the over-the-counter (OTC) forex options market. The OTC volume index highlights volume traded in the past 24-hours versus a rolling one month daily average, as per the sources of Saxo Bank. The index is a barometer of volume on liquid contracts for different crosses. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

While the risk reversal (RRs) of EURGBP is also signalling bullish risks in longer-term tenors, bullish neutral RRs across all tenors.

Please also be noted that the implied volatilities of these combinations of tenors (1m and 6m), shrinking IVs in 1m tenor that are supportive for call option writers and IVs are on rising mode in 3m-6m tenors that are conducive for options holders.

Hedging Strategy of EURGBP: Contemplating above OTC indications, we advocate diagonal credit call spread on hedging grounds that addresses both short-term downswings and long-term upside risks.

This option strategy to keep the potential bullish price risk caused out of fundamental events on check.

Keeping above OTC factors in mind, it is advisable to initiate long in 3M ATM 0.51 delta call, simultaneously, writing 1m (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Currency Strength Index: FxWirePro's hourly EUR spot index is at shy above -34 levels (which is bearish), while hourly GBP spot index is edging higher at 42 levels (bullish) while articulating (at 11:18 GMT). For more details on the index, please refer below weblink:

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?