Societe Generale notes:

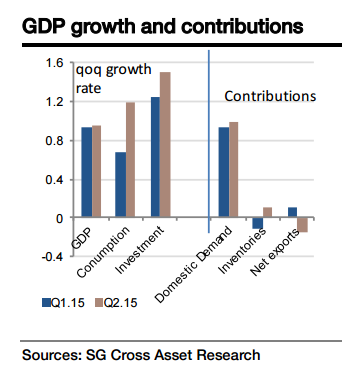

With industrial production carry over at 1.7% in May, PMI composite at 57.7 in Q2 (vs. 54.5 in Q1) and retail sales at 3.5% yoy in May, Q2 GDP growth is set to be stronger than the already impressive 0.9% Q1 GDP growth. We expect a 1.0% qoq figure, driven by domestic demand. In particular, given low interest rates (as the bulk of mortgage debt is in variable rates), low inflation, the ongoing tax reform and the improving labour market support household consumption is expected to have picked up strongly in Q2. Favourable financial conditions and lower taxes also support investment.

Looking ahead, we expect a GDP growth to ease in the second half - as many temporary factors (negative inflation in particular) will recede. On top of that, as both corporate and household indebtedness remain close to their pre-peak levels, the de-leveraging process is not over. As a result, the recent strong consumption and investment growth do not appear sustainable. Finally, with looming elections, risks of political stalemate, uncertainty and lack of reform are elevated, weighing on businesses' hiring and investment decisions.

Spain's Q2 GDP growth to reach 1.0% qoq, but ease thereafter

Monday, July 27, 2015 1:57 AM UTC

Editor's Picks

- Market Data

Most Popular

3

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed