South Korea's current account registered its largest surplus on record, with current account surplus widening to USD12.2bn in June, which was USD8.6bn in May and USD8.1bn in April. Barclays was expecting the country's current acount to post USD11bn. The larger surplus was driven by a widening in the goods balance (classic import compression) and a further improvement in the primary income account. These helped offset the deficit in the services account, which idened from USD0.4bn in May to USD2.5bn in June, on the back of the MERS shock, which has weighed on travel and other business services.

With the YTD surplus standing at USD52.4bn, Barclays expects the current account surplus to reach USD95bn in 2015 against Bok's expectation of USD89.2bn and USD84bn in 2016 against BoK's expectation of USD88bn.

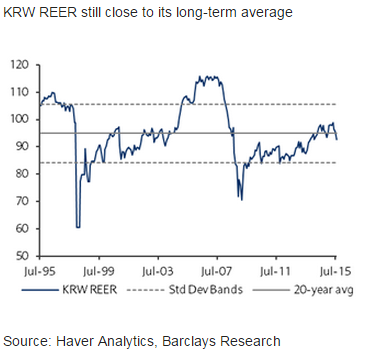

However, with activity remaining soft and the marginal benefit of any further monetary easing diminishing, analysts assume the emphasis is likely to be on other growth levers - such as engineering a weaker KRW to support growth. Indeed, on 26 June, the government announced measures to weaken the currency.

"All told, the measures will generate an additional USD20bn in potential outflows through the capital account this year, in a bid to offset the expected USD98bn current account surplus. The June surplus can only increase the pressure on the authorities to implement more measures to limit any strengthening in the KRW at a time when exports are weakening", says Barclays.

South Korea's record current account surplus adds pressure on KRW

Monday, August 3, 2015 4:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022