A modest rise in South Korea's fresh food prices is expected due to drought, which actually means a significant pick-up in seasonally adjusted prices given the well-established pattern of a sizeable decline in fresh food prices in June.

The pace of rebound in oil prices is likely to have accelerated a bit due to a moderate rise in both crude oil prices and the USD/KRW exchange rate.

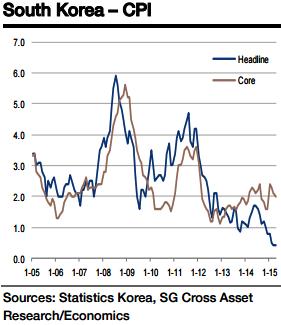

"South Korea's Headline inflation is likely to have picked up from 0.5% to 1.0% yoy and from 0.3% to 0.4% mom in June", says Societe Generale.

Headline inflation is likely to rise further in H2 this year as base effects from oil prices kick in, while core inflation should be stable around the current level until the end of this year.

"Core inflation is expected to be stable at 2.2% yoy and 0.2% mom, driven by the core manufacturing sector and housing rents", added Societe Generale.

South Korea headline inflation likely picked up, due to food and oil prices

Wednesday, July 1, 2015 4:55 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX