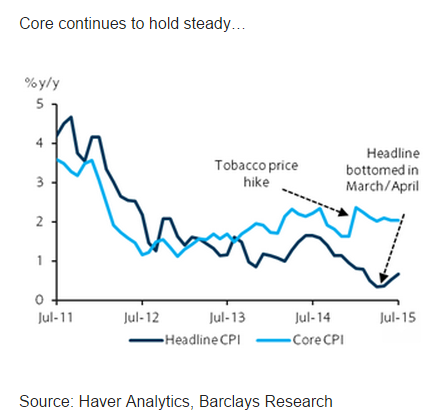

South Korea inflation came in at 0.7% y/y for July (June: 0.7%; May: 0.5%), in line with consensus. Similar to June, food inflation remained the key driver on the back of the severe drought which weighed on agriculture output. An additional driver, which helped offset the persistent oil drag and added 0.16pp to the headline CPI, was from a 6.5% increase in transport service prices. Unsurprisingly, the drag from lower oil prices persisted in July, with prices of gasoline, gas and LPG remaining subdued.

In addition, a downward adjustment in electricity tariffs deducted a further 0.14pp from the headline rate. All told, there is still no sign of deflation as core inflation held steady at 2.0% y/y (June: 2.0%; May: 2.1%). This came from a solid contribution from services inflation, which added 1.14pp to the headline inflation (Jun: 0.95; May: 0.92), indicating the threat from the MERS effect on the services economy is clearly subsiding. Looking ahead, inflation is expected to gradually rebound in H2 to an average of 1.2% on account of firming services as the shock from the MERS outbreak dissipates. Higher food prices on the back of warmer and drier weather conditions will also help keep inflation supported.

"We maintain our full year inflation forecast at 0.9% for 2015. We believe inflation remains benign and will gradually trend higher in H2. The softer-than-expected Q2 outturn has prompted us to lower our full-year GDP growth forecast by 40bp to 2.6% (BoK: 2.8%)," notes Barclays.

With the potential benefit of further monetary easing diminishing, the next significant policy move is likely to be fiscal, not monetary. Indeed, on 24 July the National Assembly passed a supplementary budget bill of KRW11.5trn, well short of expectations. Assuming it is delivered by September, the actual growth impact is only likely to be felt in the economy by Q4 and into 2016. There is still a risk of further easing in the remaining months of Q3, but only if incoming data deteriorates further.

"We maintain our base case for the BoK to stay on hold for the rest of the year, but with the focus of policy in engineering a weaker exchange rate - possibly by stockpiling more essential commodities like fuel," added Barclays.

South Korea July inflation: A tale of higher food and transport costs

Tuesday, August 4, 2015 2:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022