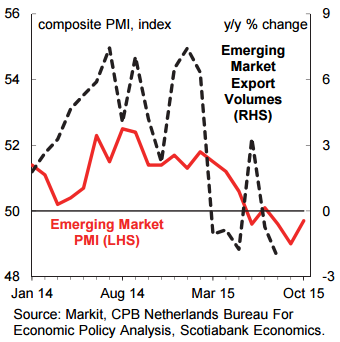

Emerging market composite Purchasing Manager's Index (PMI) contracted in four of the last five months, following almost two consecutive years of expansion. With Russia and Brazil in recession and China poised to deliver its weakest expansion in more than two decades, the economies that powered world growth in recent years are now slowing it down. Developed economies are feeling the brunt from the combined reduction in the momentum of these key developing economies. Deep slowdown in China and other emerging economies is not only masking a strengthening recovery in rich countries but also tempering the outlook for their regional trading partners and a broad range of industries.

Should the situation in the emerging markets deteriorate, growth in the euro area, as well as Japan would also be hit. Manufacturing activity in Europe is a key contributor to global growth, led by Germany, Spain and the UK. The industrial sector in Germany, however, has come under pressure in recent months in response to weaker demand from emerging markets. German manufacturing activity, exports, and new orders for autos and parts have all been on a moderating trajectory in recent months, and business climate surveys have been softening.

According to OECD, the outlook for Japan remains softer than in other advanced economies, despite an anticipated upturn in real wage growth. This reflects a larger drag exerted by weak external demand, especially in Asia, and strong fiscal headwinds. Japanese GDP is expected to grow 0.6 percent this year and 1 percent next, while the euro area's expansion is now seen at 1.5 percent in 2015 and 1.8 percent in 2016, a reduction by 0.1 percentage point for each year. The fears about the stagnation scenario are being reinforced not only by the slowdown in EM and falls in commodity prices, but also by a recent tightening of financial conditions in developed markets, and the behaviour of the corporate sector.

As details from the Chinese government's latest '5-year plan' start to emerge, it is evident that China will be transitioning to a far less robust growth trajectory compared with the last decade, promoting urbanization, a consumer focused economy, and enhancement of the service sector. October PMI report revealed that China's non-manufacturing activity picked up slightly from a fourteen-month low. Chinese manufacturing contracted for the eighth consecutive month in October, albeit at a slower pace compared with September, on the back of an increase in export orders, while domestic demand remains weak. Job creation in services has been fairly flat in recent months, but future hiring plans have fallen to a decade low amidst uncertainty surrounding global economic activity and the structural shifts occurring in China.

The IMF last month has cut the global growth forecast for 2015 from 3.5 per cent in April to 3.1 per cent with a gradual recovery in the years ahead as it expects the faster growing emerging economies to recover and continue to account for the lion's share of global expansion. The fund said risks to its forecast were clearly tilted towards a more pessimistic outlook with much reduced chances of a high growth outcome in 2016. It is concerned that low commodity prices combined with high debt in many emerging economies will cause bankruptcies which might create wider financial strains.

The terror attack in Paris is making investors nervous. Emerging-market stocks declined toward a six-week low and currencies weakened on rising risk-off sentiment. The MSCI emerging-markets gauge decreased 1.1 per cent to 812.23, extending the steepest weekly slide since Sept, on deepening concern that geopolitical tension will curb trade and slow global growth.

Slow down in momentum across Emerging Markets tempering global growth outook

Monday, November 16, 2015 10:43 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate