Singapore’s core consumer price inflation is expected to rise to 2 percent during the month of August and edge higher into year-end, according to the latest report from ANZ Research. Therefore, a further slight tightening in monetary policy by the Monetary Authority of Singapore (MAS) at the policy meeting in October can be expected.

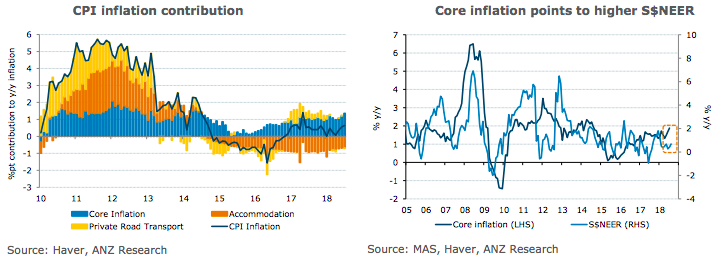

CPI-All Items inflation came in at 0.6 percent y/y in July, unchanged from the previous month. This was in line with market expectations. On a sequential basis, the CPI index fell 0.1 percent m/m. Higher utility prices were offset by falls in accommodation and private road transport costs in the month.

Of more significance for monetary policy is the fact that core CPI inflation increased to 1.9 percent y/y. After a period where it had stabilised at around 1-1/2 percent, the increase over the past two months has taken core inflation to its highest level in four years.

Core CPI inflation continues to rise after a period of stability. From a recent low of 1.3 percent y/y in April, core inflation has risen to 1.9 percent in July, the highest since August 2014. The increase in utility prices contributed to the rise in core inflation, but the Monetary Authority of Singapore (MAS) expects domestic sources of inflation to increase alongside a faster pace of wage growth and a pick-up in domestic demand.

"For now, the MAS has left their core inflation forecast unchanged, expecting it to average in the upper half of the 1-2 percent forecast range in 2018. With the Singapore economy evolving as the central bank expects, a further slight tightening in monetary policy at their October meeting remains our base case," the report added.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment