Ever since the BTC futures were launched about two months ago, we’ve seen series critics as well as massive turbulence in the underlying currency BTCUSD, it has shot up to 19k mark and tumbled below 10k again, now settling at or near 11k mark.

We at FxWirePro have already stated several times in the recent past, that safeguarding arrangements with BTFs (bitcoin futures available at CME & CBOE), well, the knack of trading Bitcoin futures on exchanges (CME and CBOE), which are predominant universally, renders highly essential level of transparency, investor protection, and credibility to the price–discovery process and creates a level of institutional legitimacy that is crucial for growth in this sector.

The effect on bitcoin spot is not conclusive, but signs of momentary dislocation, and possibly manipulation, exist.

To illustrate this point, we look specifically at the CBOE contract that settled every month on the Wednesday prior to the 3rd Friday at approximately 4 pm EST. The settlement price is the auction price on the Gemini exchange.

Gemini is an exchange that, at press time, trades a relatively small average daily volume of $60M of BTCUSD transactions. This tells us that it doesn’t take much volume to have a temporary impact on the price of BTC on that exchange. On a day when futures are expiring, it’s likely that major market participants can affect the price of BTC spot in order if they are hedging their delta exposure. Other traders may well see this and jump into the market for a risk-free transaction – that is if they are quick enough.

We qualify this statement by looking at what the price of BTC did on Gemini versus another liquid exchange like GDAX at expiration. The thesis going into the exercise is that the Gemini price probably traded at a deeper than normal discount to the GDAX price, given the significant short interest in BTC futures.

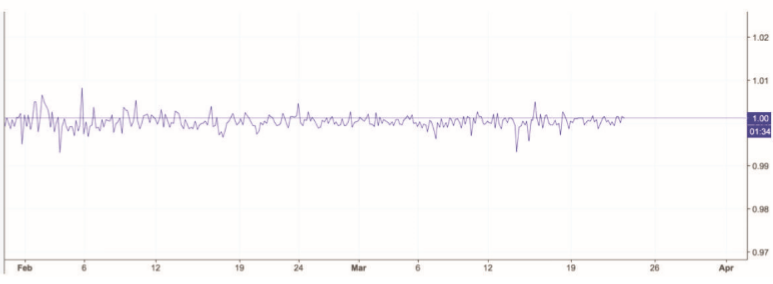

First, we get a baseline for the BTC price relationship BTC between the exchanges. The graph above indicates the plot of BTC Gemini / BTCGDAX daily prices in the past couple of months. For the most part, the prices move in tandem when viewed in this time horizon.

We now gaze at the last couple of expiration dates, explicitly Feb 14 on the left and March 14 on the right, and with 1-minute interval data. It is discovered that our thesis is correct. The price of BTC on Gemini traded at approximately a 2% discount to that of GDAX. This was likely due to market makers hedging their books and causing a dislocation along with statistical arbitrage firms both acting on the dislocation and bringing prices back to fair value.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed