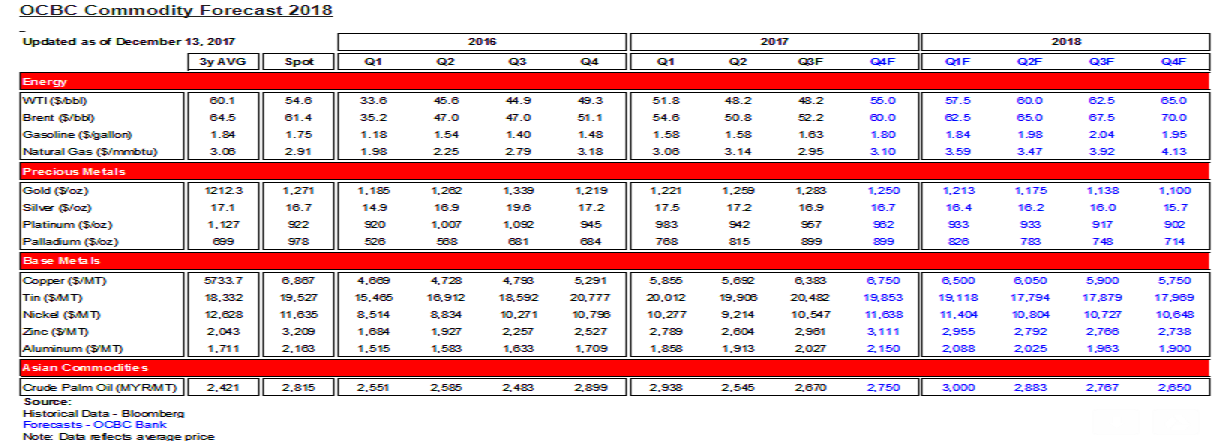

The rise in energy prices is expected to be met by a stronger oil production in the United States, with upside risks limited going into 2018, according to a recent report by OCBC Bank. Factors into 2018 could prove to be different, fraught with even more uncertainties that are bereaved of answers.

Geopolitical tensions remain high, while energy demand could moderate into the year given a strong 2H17 base. Supply-wise, recent OPEC’s ‘soft’ deadline to extend oil curbs for nine months could mean an earlier-than-expected cessation of the deal. A further rise in prices could well be met by stronger US production as shale oil players turn taps on, suggesting that upside risks could well be limited into 2018.

The global economic outlook into 2018 should prove to be a rosy one; IMF tips global growth at 3.7% in 2018, a tat faster than an estimated 3.6 percent in 2017 according to their October WEO report. The recent FOMC dot-plot chart continues to suggest three more rate hikes next year (although the current futures curve is pricing in one to two more hikes instead).

2017 has been an eventful year, especially for the energy complex. At the very least, crude oil prices have rallied from its low of the USD42/bbl handle in June to marginally exceed our year-end outlook of USD55/bbl. The uptick in oil prices is underpinned by the fruition of OPEC’s production cuts effort, recovering global growth and the consequent rebalancing fundamentals.

However, factors into 2018 could prove to be different, fraught with even more uncertainties that are bereaved of answers. Geopolitical tensions remain high on our list, while energy demand could moderate into the year given a strong H2 2017 base. Supply-wise, recent OPEC’s soft-deadline to extend oil curbs for nine months could mean an earlier-than-expected cessation of the deal.

"We think that upside risks for crude oil prices in 2018 is limited. Although the rally momentum has picked up into 2H17, the higher prices of late have also triggered more US oil supplies. The somewhat fragile rebalancing act wrenchingly meted out by OPEC+Russia could be once again threatened by the return of US shale oil supplies should prices rally further," the report commented.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility