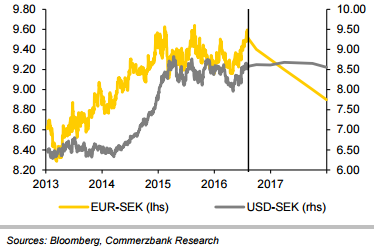

The Swedish central bank, Riksbank, has given sufficient evidence that it is quite responsive when considering inflation risks. Therefore, it is likely that the central bank would carry on managing averting an unwanted, rapid and robust strengthening of the Swedish krona in the quarters ahead, said Commerzbank in a research report. Since the end of 2015, the EUR/SEK pair has moved downwards below the 9.10 level.

The market is not testing the central bank’s threshold of pain that signifies that it expects the Riksbank to be credible, stated Commerzbank. If there is a possibility of the Swedish currency to strengthen quite rapidly against the euro, the central bank is expected to further loosen its monetary policy. The Riksbank has mentioned that it might further ease its key rate, expand its bond buying or also intervene in the foreign exchange market.

The likelihood of the central bank intervening has dropped however since the SEK has recently come under depreciation pressure after the Brexit vote and weaker growth data. Furthermore, the central bank would be able to take in a stronger currency the higher the inflation data turns out to be. Therefore, the Riksbank, over the course of the year, is expected to accept a gradually stronger krona against the euro, added Commerzbank.

Riksbank likely to accept gradual appreciation of krona against euro

Friday, August 12, 2016 12:30 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX