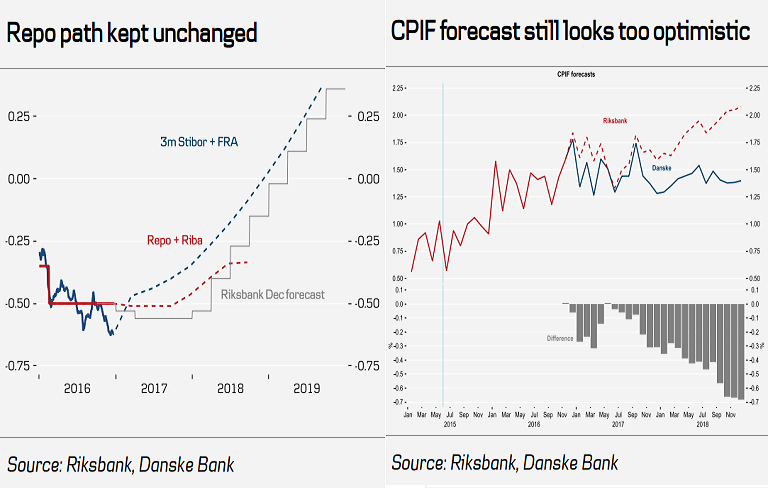

The Swedish central bank (Riksbank) kept its policy rate on hold at -0.5 percent at its policy meeting today and delivered SEK30bn in extended QE as expected (SEK15bn nominal and SEK15bn linkers) running to mid-2017. The repo rate path was kept unchanged and therefore still has a short-term easing bias.

Furthermore, the Riksbank would be reinvesting maturities and coupon payments on the government bond next year to a value of about SEK 30 billion. There would be a huge maturity in August, but reinvestments would start at the beginning of next year and are planned to continue throughout 2017.

The Riksbank kept its inflation forecast almost unchanged after the big reduction in October. The central bank expects CPIF-inflation to average 1.6 percent next year and 1.8 percent in 2018. Meanwhile, it projects core inflation to be at 1.3 percent next year and 2 percent in 2018. It also left the growth and employment outlook unchanged.

The governing board was divided in its decision on extending the QE program with governor Flodén, Skinglsey and Ohlsson making reservations. The minutes from the monetary policy meeting will be closely watched. Inflation continues to be a challenge for the central bank and it is unlikely to reach the target rate by the end of 2018.

Moreover, the trade-weighted SEK is likely to be a bit weaker compared to the October forecast. The SEK is already trading at a stronger rate than the Riksbank forecast for first quarter 2017. Given the current SEK forecast, there is a clear risk that the central bank would be challenged again in 2017.

“We think the Riksbank is closer to the end of the easing cycle and thus it makes sense to start building short positions in EURSEK. The krona is also likely to receive support from better growth momentum and the perception that the krona is trading at fundamentally cheap levels”, said Danske Bank in a report.

Swedish Krona was volatile after the rate decision. SEK bounced around after the announcement and pulled back a little of its recent weakness. EUR/SEK was down 0.72 pct on the day and USD/SEK was down 1.1 pct at the time of writing.

FxWirePro's Hourly EUR Spot Index was at -69.151 (Neutral), while Hourly USD Spot Index was at 22.9409 (Neutral) at 1230 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says