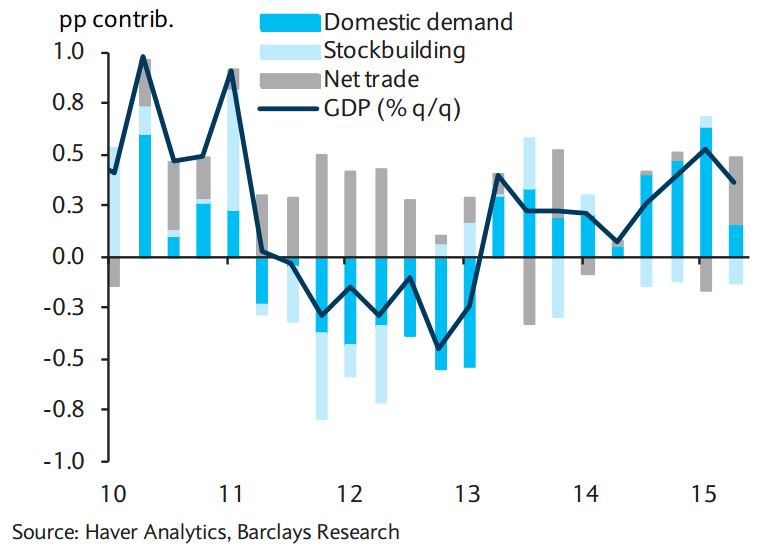

The final estimate of euro area Q2 15 GDP was revised up slightly to 0.4% q/q (1.4% q/q saar from 1.3% q/q saar in the flash reading) on the back of upward revisions to Italian and Greek Q2 growth. Euro area Q1 15 GDP was also revised up 0.1pp to 0.5% q/q. Looking at the expenditure breakdown, the main positive surprise came from net trade, which recorded the strongest contribution to growth since Q4 13 (+0.3pp vs. our expectations of +0.2pp, Figure 1).

"This positive performance was driven by stronger exports, which we think benefitted from the positive impact of past euro depreciation, while imports slowed slightly, in line with domestic demand. The contribution of the latter to growth was significantly lower than in Q1 (+0.2pp from +0.6pp in Q1), mostly owing to a sharp drop in investment of 0.5% q/q, partially erasing Q1 gains (+1.4% q/q), while private and government consumption growth also decelerated. Looking ahead, we expect private consumption to remain the main growth driver, supported by renewed weakness in oil prices (and therefore weak inflation) and slowly improving labour market conditions (both employment and wage growth)," notes Barclays.

Barclays also noted that investment remains a source of uncertainty and projects only a modest rebound.

"Underpinning our expectations, we see merely moderate growth in productive investment, as very supportive financial conditions are offset by low growth prospects and high uncertainty, while construction investment should recover only slowly after the long downward adjustment that started in 2008. Finally, net trade will likely face opposing forces: weaker external demand from China and most emerging market countries versus further strength in euro area exports to advanced economies, in particular the US and non-euro Europe."

Chinese imports from the EU have been on a downward trend since the beginning of the year, with the latest August data pointing to a worrying contraction of c.15%. Nonetheless, with a one-month lag, July German and French trade balances released this week showed resilient exports, especially driven by demand from advanced countries. National industrial production (IP) data for July were mixed across countries, as Germany and France disappointed, while Italian and Spanish IP surprised to the upside. A rebound in construction drove the moderate rise in German IP, while all manufacturing subcategories - except coke and refined petroleum products - fell markedly in France.

Overall, tepid momentum should continue, contrasting slightly with solid manufacturing business surveys. In a speech at Eurofi in Luxembourg on Wednesday, ECB board member and Chief Economist, Peter Praet, explained that low interest rates were "a consequence of weak secular trends, coupled with the cyclical consequences of a complex debt crisis, exacerbated by a monetary union with institutional and structural flaws." He concluded that normalisation towards a situation where interest rates are higher would happen only gradually once these "underlying drivers that are holding real rates and inflation expectations down" were addressed, which requires structural and institutional reforms in the euro area. He echoed President Draghi's comment that the Governing Council was willing and able to act, if warranted, to counter downside risks on the inflation outlook.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022