The recent rise of Chinese technological brands at the expense of a wide range of small players in Europe, US and Asia, could possibly reinforce foreign concerns about Chinese competition in the global tech sector, according to the latest report from DBS Group Research.

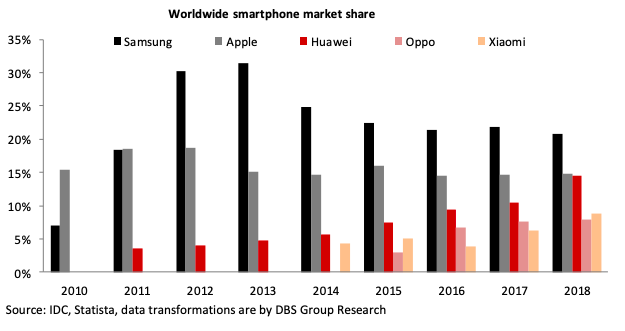

Chinese firms have been growing rapidly in the smartphone sector. Huawei boosted its global market share to 14.6 percent in 2018 from 10.5 percent in 2017, on par with Apple’s 14.8 percent; while Oppo and Xiaomi have gained in the last 2-3 years.

Chinese brands account for more than 40 percent of global smartphone shipments today, far exceeding Samsung’s 21 percent. The decline of Samsung started from 2014, well before the deterioration in South Korea-China political ties and the Chinese boycott of Korean products in 2017.

The decline of Apple started from 2013, also far before the US-China trade war broke out. The advancement of Chinese smartphone makers is not new and has been ongoing for many years, which could be attributed to the structural factors such as technology/product maturity, price competitiveness and marketing success.

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy