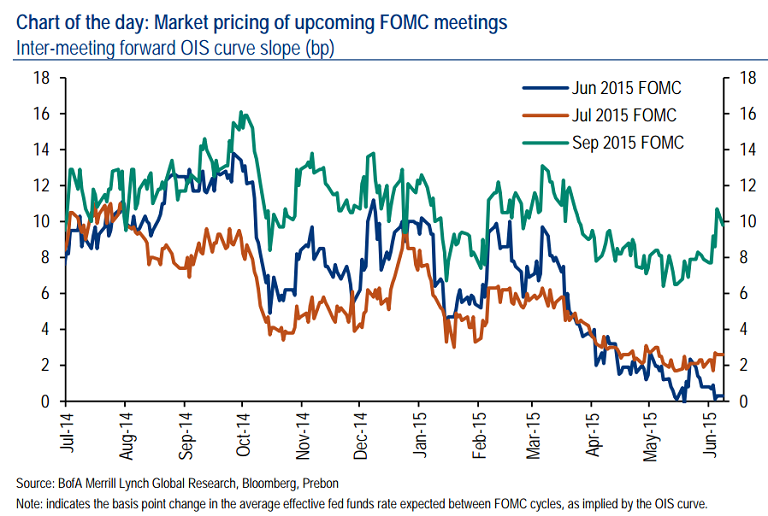

Next week's FOMC meeting will be pivotal, but not because a rate hike is likely. Indeed, the rates market sees a near-zero probability of a hike in June, despite Friday's strong employment report. The July meeting is expected to be a non-event as well, with just 2.5bp of slope priced into the inter-meeting forward OIS curve.

Unsurprisingly, the market is treating September as the first truly "live" meeting. Market-implied odds of a September liftoff have increased somewhat over the past few weeks as data have improved, but with 10bp currently priced in, the market remains unconvinced a September hike is likely.

This likely reflects lingering uncertainty about the prospects for a growth rebound after a disappointing start to the year. However, our 2Q GDP tracking model now stands at 2.9%, as Ethan Harris notes. With growth picking up, Sept remains our base case for the first Fed hike, a view that was affirmed by the latest employment report. In light of this, we reiterate our Aug-Oct 2015 forward OIS curve steepener recommendation (11 bp), which we continue to see as a cheap way to position for a Sept rate hike, said BofA Merrill Lynch in a report

Rates market continues to underprice the likelihood of a Sept Fed hike

Tuesday, June 9, 2015 6:01 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed