The Reserve Bank of New Zealand (RBNZ) is widely expected leave the OCR at 1.75 percent at the June OCR announcement next Thursday. Markets expect little change in the RBNZ's policy statements. The central bank is set to maintain a clear and consistent message and will will likely maintain its wait-and-see approach.

The recent lacklustre data out of the economy and rising downside risks will keep the central bank cautious. New Zealand GDP data confirm that economic momentum is gradually moderating. The New Zealand economy expanded by 0.5 percent q/q in Q1, in line with consensus expectations, a more modest pace of growth than the 0.6 percent recorded in Q4 2017.

Inflation pressures are also subdued. That said, global inflation is likely to increase and depreciation in the exchange rate will provide a further boost. However, inflation increase will only be very gradual and the central bank will remain cautious until inflation shows more consistent signs of life. Majority of economists polled by Reuters also expect the central bank to remain unchanged on rates well into Q4 2019.

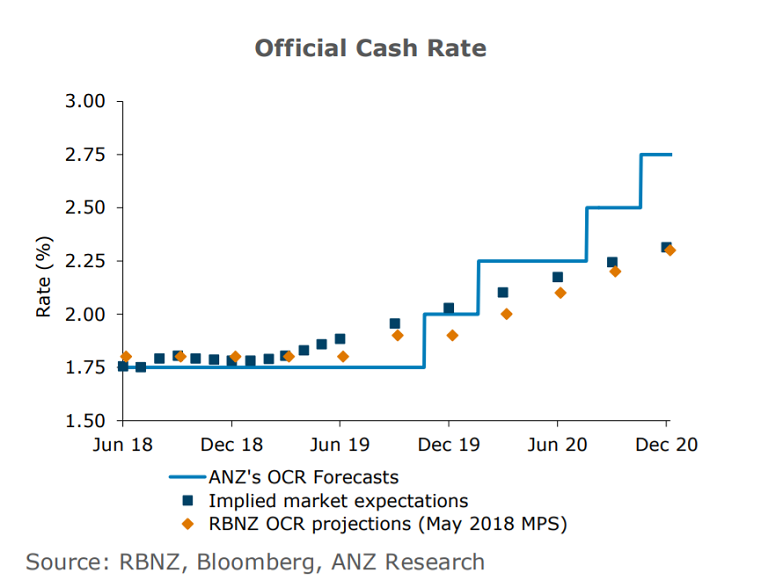

"We expect no change in message from the RBNZ. We now expect the OCR will lift in November 2019, rather than August, consistent with a softer outlook for GDP growth and a more gradual increase in inflation," said ANZ in a report to clients.

We expect the kiwi to weaken as we head into the RBNZ. Lack of adjustment in the underlying statements will see the Kiwi resume its downward trading stance. Technically, NZD/USD fails to hold break above 5-DMA, extends downside for a second straight session. The pair is trading 0.41 percent lower on the day a 0.6867 at the time of writing. Bulls have failed to extend momentum higher, the pair is testing major trendline support at 0.6865. Break below will see further weakness. Scope then for test of 0.6780 levels.

FxWirePro's Hourly NZD Spot Index was at -115.451 (Bearish), while Hourly USD Spot Index was at -81.8342 (Bearish) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?