The Reserve Bank of India (RBI) meets on December 6th to decide monetary policy and analysts largely expect the central bank to hold repo rate unchanged at 6.00 percent. The central bank is expected to stay pat as oil concerns resurface. That said, a rate cut is not completely off the table. Analysts at ANZ note that most of the concerns that the RBI has been highlighting are unlikely to materialize and still see scope for one rate cut.

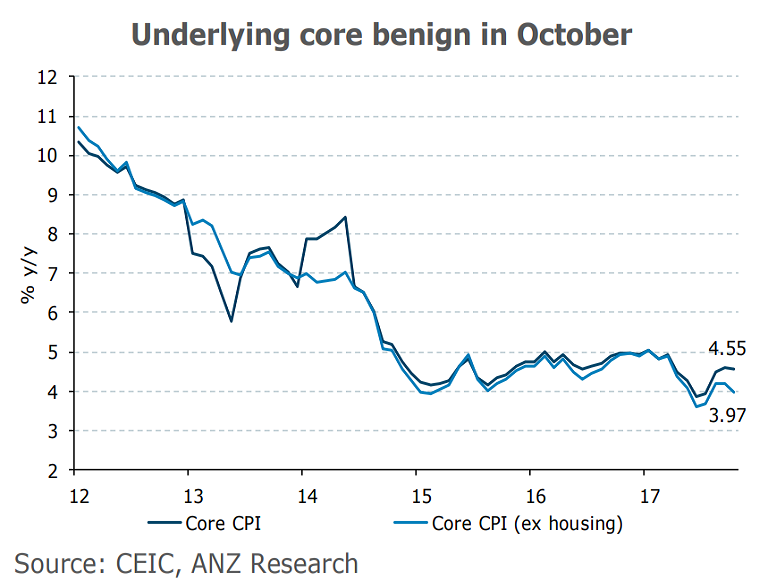

India's inflation picture has changed since August when the RBI delivered a 25bp cut after remaining on hold for 10 months. After hitting a series low of 1.5 percent y/y in June, the headline CPI has risen to a seven-month high of 3.6 percent y/y in October. Rising oil prices pose an upside risk to inflation and hence inflation is expected to rise in the coming months. However, drivers of core inflation have predominantly been policy-related and demand side pressures remain largely absent.

"Barring the risk of a sharp upside surprise to oil prices, we think that inflation will remain contained and more importantly, start to reflect the weak growth conditions again," note ANZ in a report.

Majority of the activity indicators have also remained soft. Supply-side disruptions has kept growth subdued for longer. Data released earlier this month also showed that India's manufacturing PMI also stagnated in October at 50.3 as compared to a reading of 51.2 in September.

Slight deviation in the fiscal deficit in FY2018 is expected due to a potential revenue shortfall following GST implementation. However, government’s fiscal consolidation credentials are intact over the medium term and an upgrade my ratings agency Moody’s Investors Service supports the view. On November 17, Moody’s Investors Service upgraded India’s sovereign rating by a notch to Baa2 from Baa3, the first upgrade in 14 years.

"We now expect the Reserve Bank of India (RBI) to cut its repo rate by 25 bps to 5.75% in February 2018 instead of December 2017 previously. The consensus forecast is for the RBI to remain on hold through 2018," said ANZ in a research note.

INR has strengthened in recent weeks despite higher global crude oil prices. USD/INR was trading at 64.30 at the time of writing, down 0.24 percent on the day. Technical studies support further downside in the pair. Price action remains below Ichimoku cloud and major moving averages. Test of 63.75 (Sept 8th low) looks likely in the upcoming weeks.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary