As inflation expectations rise globally, the US Federal Reserve is expected to hike rates at a faster pace next year. Last week, FOMC forecasted 3 rate hikes, compared to just one each in previous two years. Then why the governments are still able to sell bonds at negative rates? Last Friday, the United Kingdom for the first time sold bonds at negative rates. The government was able to borrow £1 billion at minus 0.1038 percent. The negative bond universe is squeezed but still close to $10.8 trillion. In August, this universe was as big as $13 trillion.

Part of the answer lies with Quantitative Easing. Several major central banks around the world are still pursuing quantitative easing. The European Central Bank (ECB) earlier this month announced a further purchase of €540 billion bonds till December 2017, once the current program expires in March 2017. Not only that, the ECB announced that it would now purchase below the deposit rate, which is at -0.4 percent. Since the ECB announcement, German 2-year yield has been declining to record low and currently trading at -0.8 percent.

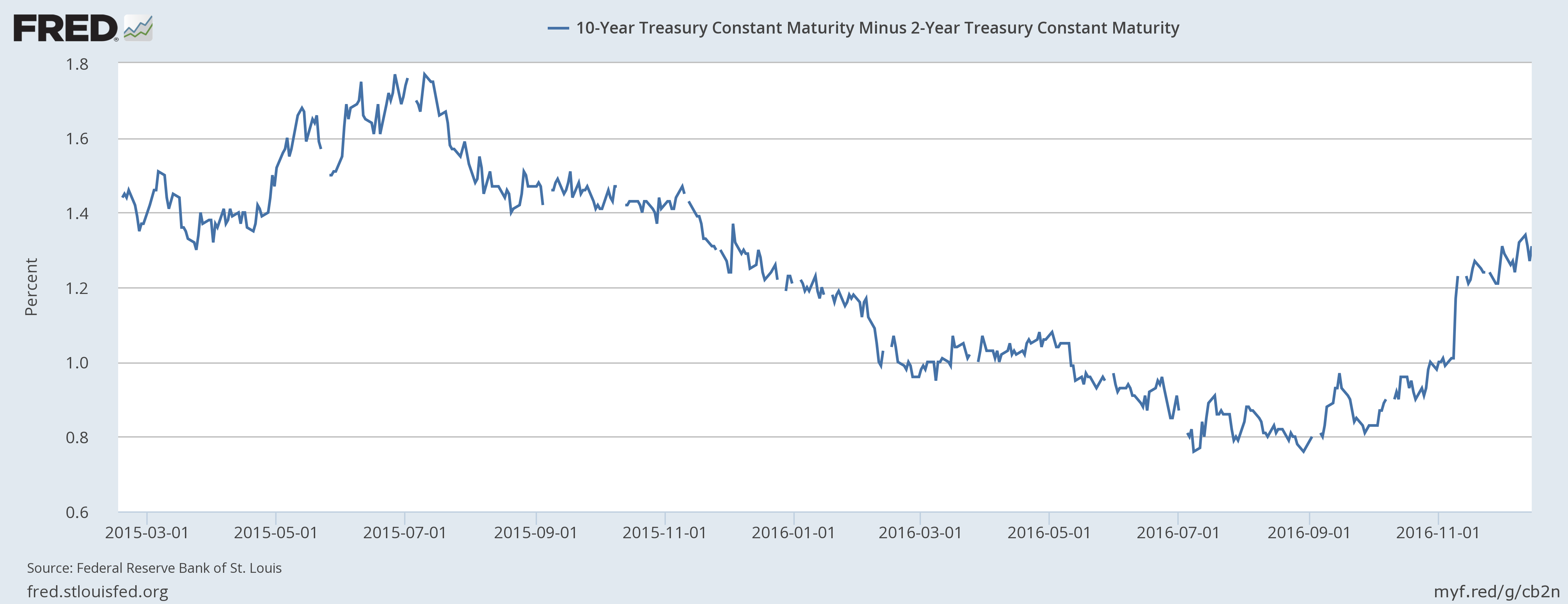

With rising inflation expectation globally, the market is and will return to the very fundamental that the central banks can control the short term rates but have hardly any control over the longer end of the curve, which gets determined by a variety of factors in the economy. The spread between the US 2-year and 10-year treasury has jumped by 56 basis points since September to 1.32 percent.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.