When European leaders meet at the end of this week hope is that an agreement will be finalised between the UK and its EU partners, paving the way for the referendum to then take place on 23 June. If the UK were to decide to leave the European Union it would be a negative event both for the UK economy and the rest of the European Union. Such an event would only add to the challenges of both the BoE and ECB.

On the other hand, a vote against "Brexit" would see the political risk premium disappear from GBP. The current political risk premium in GBP is around 7%, and opinion polls show a 50:50 divide in voting intentions. The premium is expected to disappear if voters reject "Brexit" but, would most likely at least double should the UK vote to leave. The sterling is definitely set for a rocky ride in the next few months. The pound has fallen about 8 per cent since Nov on a trade weighted basis on account of the uncertainty surrounding the Brexit vote.

The UK's General Election in 2015 is a good example of how the political risk premium appears and disappears swiftly. Polls in the run-up to the 2015 general election suggested the outcome would be neck-and-neck. A month before polling day, GBP-USD was around 4% weaker than interest rate differentials were implying, likely reflecting the "political risk premium" for this event. The actual result was a surprising overall majority for the Conservative Party. GBP-USD perfectly re-aligned with interest rate differentials as the political risk premium disappeared.

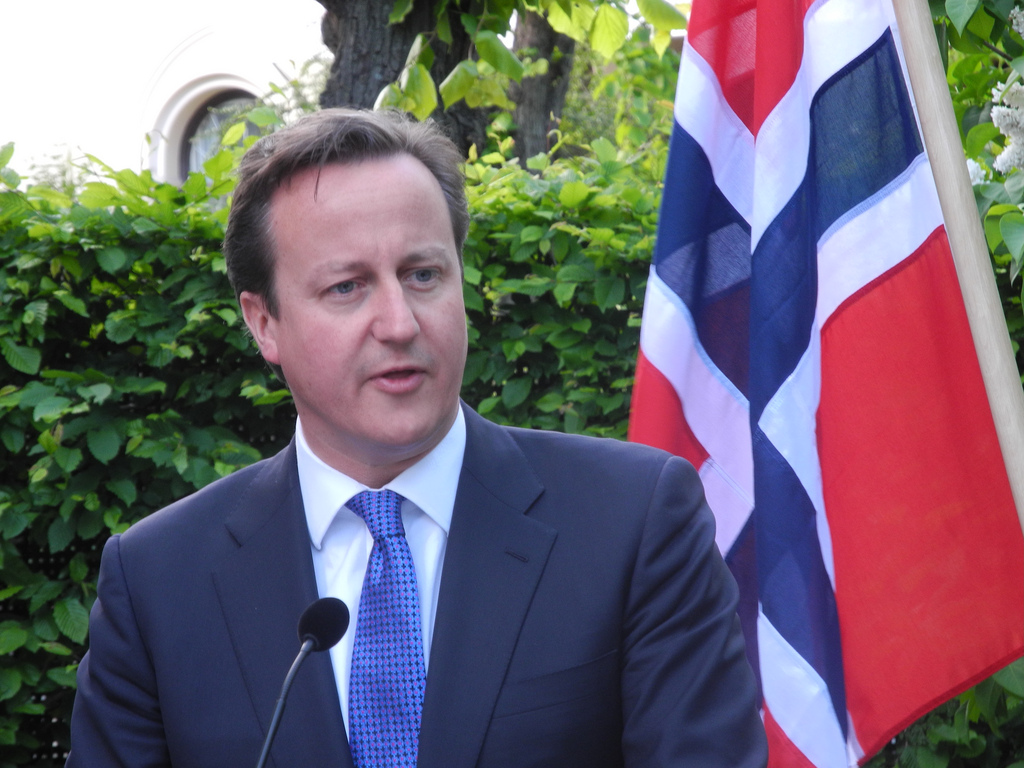

"We estimate the UK's current political risk premium in GBP to be around 7% based on where UK-US interest rate differentials suggest GBP-USD should be trading. This premium will ebb and flow depending on the signals from the opinion polls and how successful PM Cameron's negotiations prove. But a rejection of "Brexit" would see this gap closed immediately, pushing GBP substantially higher. For example, based on the current political risk premium, it would push GBP-USD back to 1.55", notes HSBC in a research note.

GBP's vulnerability would be much more than just the knee-jerk political risk premium reaction. There are fears that a potential Brexit could spark a recession. A poll of British and German companies operating in the UK has found that almost a third would consider moving jobs out of the country following a vote to leave the European Union. Nomura, the Japanese bank, warned that the pound could fall 10 per cent to 15 per cent if overseas investors prove unwilling to finance Britain's current account deficit. With a current account deficit already at 5% of GDP, GBP can ill afford any additional widening.

Potential for turbulence in the sterling markets, more than just a knee-jerk political risk premium reaction

Monday, February 15, 2016 11:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022