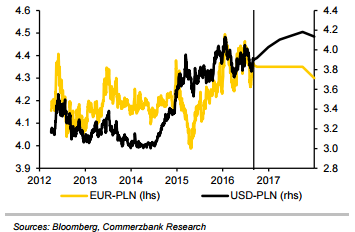

The Polish zloty is expected to remain volatile in the coming year owing to policy risk. Fluctuations are expected around a central target level of about 4.35 in EUR/PLN, said Commerzbank in a research note. In 2016, sharp swings are already been seen up to the levels close to 4.50 earlier in January-February. The currency pair has also rallied back to 4.25.

Alternating bouts of deteriorating political risk perception and effect of external developments are mainly driving these changes. Recently, U.K.’s vote to leave the EU posed as a negative shock.

“That said, we have revised our central EUR/PLN target from 4.45 to 4.35 last month as political risk perception is finally calming down after the government watered down its FX mortgage loan conversion plan, which had been a major point of concern for the banking system”, added Commerzbank.

Banks are now expected to face just PLN 5 billion losses from a ‘limited version’ of the scheme that would concentrate on reimbursement of bid-ask spreads. Earlier, markets were worried of losing PLN 60 billion for a full conversion of all loans at non-market exchange rates.

“We still see EUR/PLN calming down to around 4.30 by the end of 2017 as policy visibility improves”, stated Commerzbank.

Polish zloty likely to remain volatile in coming year owing to policy risk

Thursday, September 8, 2016 10:20 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022