Poland's September real sector indicators were uninspiring (Figure 1). For industrial production, the 4.1% y/y reading was better than expectations. Confusingly, the headline figure shows a deceleration, while the SWDA reading turned slightly higher to 4.2% y/y from 3.6% in August.

Retail sales were similar. The headline figure was well below expectations, but SA constant price retail sales climbed to 2.6% y/y from 1.35% in August. Overall, the signal for the growth trend is mixed. IP and retail sales have been volatile, but have lost some lustre in Q3 compared with the very high readings in Q2.

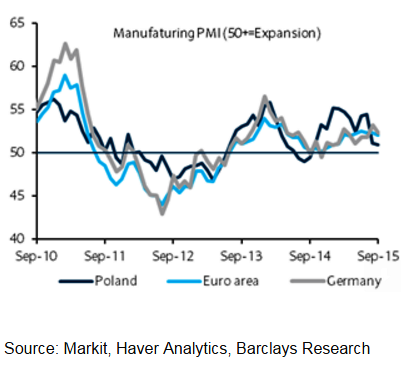

Recently, PMI has pointed lower while still remaining above 50. Over the long term, both indicators tend to follow German economic trends closely, which are pointing slightly higher.

"It would be hard to find these readings encouraging, as they do not appear to support the government view that growth is accelerating. However, it is too soon to conclude that growth is in a deceleration cycle either. The results of Sunday's (25 October) Parliamentary elections are awaited", says Barclays.

Poland's lacklustre industrial production and retail sales

Tuesday, October 20, 2015 4:37 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX