The Monetary Policy Council of the National Bank of Poland (NBP) decided to keep the interest rates on hold at last week's meeting and indicated that it may not start to lift interest rates next year as analysts had predicted. The Council noted that inflation in the quarters ahead is expected to stay moderate amid waning impacts of the past rise in global commodity prices, with just a gradual rise in domestic inflationary pressure stemming from rebounding domestic economic conditions.

The reference rate was kept unchanged at 1.5 percent, while the Lombard rate, deposit rate and rediscount rate were kept on hold at 2.5 percent, 0.5 percent and 1.75 percent. NBP governor Adam Glapinski said the central bank might not need to hike rates until the end of 2018. He said the economy was balanced, core inflation remained low and the zloty was at the right levels.

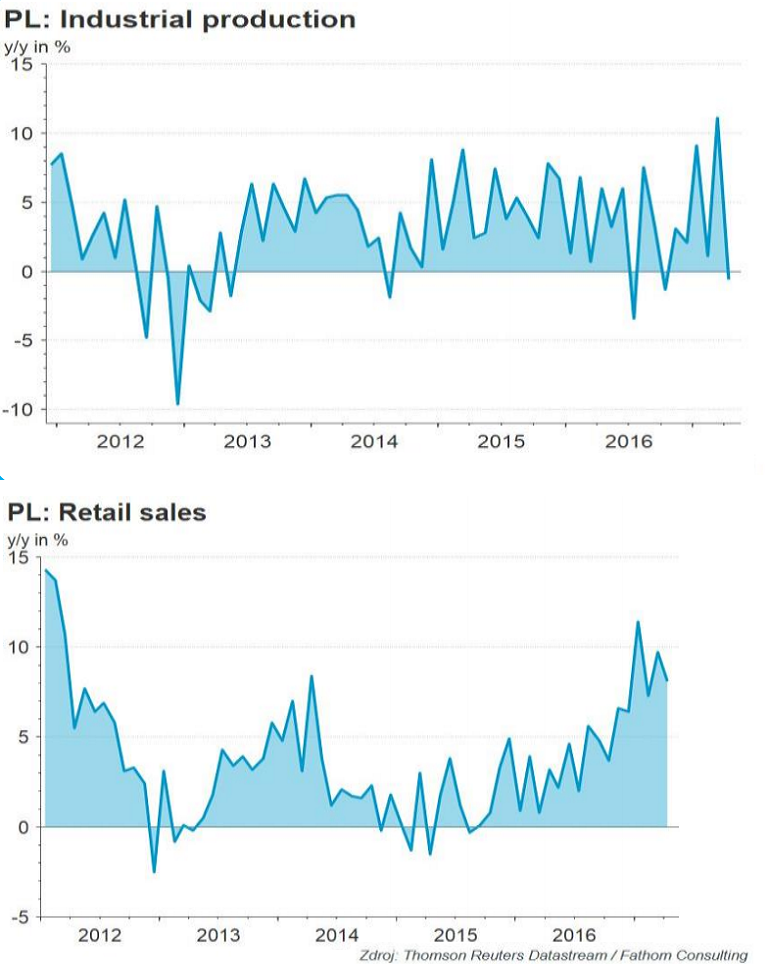

Data for April, released by the Polish Statistical Office showed that Polish industrial production data for April disappointed. Headline industrial output made a splash by falling 0.6 percent y/y missing expectations of 1.9 percent increase. Seasonally-adjusted industrial production grew by 4 percent y/y. Data showed that the trend in Polish manufacturing accelerated noticeably over the past quarter compared to a much shallower trend over the previous two years.

Retail sales data also increased very strongly in April. In real terms, they grew by 6.7 percent year on year, suggesting that household consumption in Poland is growing at a robust pace. The overall impression from "hard" macro data is that overall GDP growth in the second quarter will also be very solid. Analysts also believe that Polish growth could still remain healthy, but the acceleration of Q1 may not repeat. Moody’s ratings agency reaffirmed its A2 rating for Poland and changed the outlook from negative to stable.

PPI inflation in Poland moderated by more than expected, pointing to a lack of inflationary pressure. Meanwhile, core inflation, though gradually rising, stays low, which indicates towards still limited demand pressure. In spite of rising employment and wages, growth in unit labor costs stays moderate. Nevertheless, inflation is very unlikely to reach even the NBP’s inflation target (2.5 percent).

"The official interest rates of the National Bank of Poland should remain unchanged throughout the year, even though inflation will rise this year. The NBP will maintain an ultra-easy monetary stance as a result of which we see EUR-PLN rising over coming months," said KBC Markets in a report.

EUR/PLN was trading at 4.1914 at around 1200 GMT. FxWirePro's Hourly EUR Spot Index was at 141.078 (Bullish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains