After Fed Chair Janet Yellen's speech on Friday, markets are locked, loaded and ready – a move is priced in, near-unanimously expected by forecasts, who on balance now also agree with the Fed’s projection of three moves this year. With payroll data due Friday, a decent showing from those figures probably represent the final confirmation for a move next week. Only an extremely weak jobs report could offset a Fed rate hike at March meeting.

This week's employment data will receive plenty of attention. The US labour market is scheduled to release this week the ADP private employment report on Wednesday, weekly jobless claims on Thursday and the government's latest monthly payrolls on Friday. February's jobs data will be in focus and many see it as the final hurdle to an increase.

The Federal Open Market Committee starts its next two-day policy meeting on March 14. The Fed Funds Futures currently pricing in a probability of more than 96 percent of a rate hike this month. Hence even if this Friday’s payrolls report comes in a bit softer than expected a 25bps hike can be expected this month taking the range for the Fed Funds Rate to 0.75-1.00 percent. Markets are now more aggressive for the rest of the year, moving closer in line with the 'dot plot' indication of three hikes.

That said, Minneapolis Fed President (a voting member in this year’s FOMC) stands out among the policymakers who have been calling for faster rate hikes in 2017. During an interview with Reuters, Mr. Kashkari indicated that he would maintain his dovish outlook with regard to interest rates.

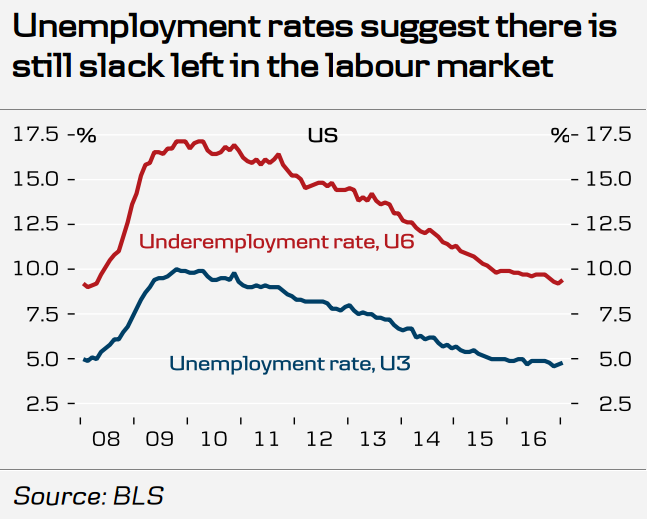

Preliminary labour market data for February have been strong with low initial claims and Markit PMI employment index pointing to significant labour market progress. Danske Bank expects solid labour market data in February. Danske Bank estimates non-farm payrolls increased by 190,000 in February in line with the recent trend. Unemployment likely remained flat at 4.8 percent and that average hourly earnings increased 0.3 percent m/m, implying a small increase in the wage growth rate of 2.8 percent y/y.

"The jobs report for February due on Friday seems to be the last thing which potentially could halt a Fed hike at the upcoming meeting. As we expect the jobs report to be good, we expect the Fed to deliver," said Danske Bank in a report.

EUR/USD found renewed selling pressure at highs around 1.06400. The pair has once again broken the 1.06000 handle. It is currently trading around 1.05769. Further upside likely only above 1.0660 level. Meanwhile, USD/JPY has edged higher to retake the 114 handle. FxWirePro's Hourly Dollar Strength Index remained neutral at -17.0513 at around 1300 GMT (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate