Global oil prices are expected to remain bearish during the first half of this year, while a slight rebound can be expected by the second half, according to the latest report from OCBC Treasury Research.

The triple threat of US-China trade tensions, the ongoing US government shutdown and the increasing possibility of a no-deal Brexit are all capping the limit on crude’s advance at the moment.

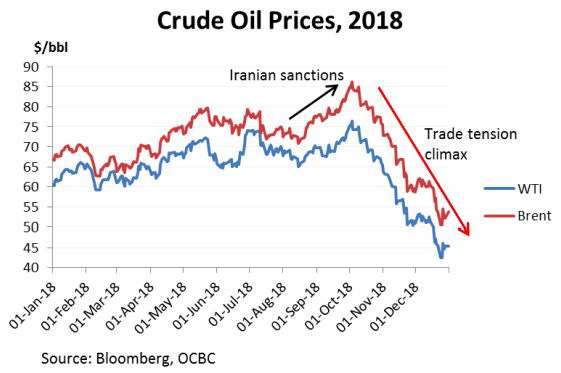

A risk-on January, fuelled by a better-than-expected US jobs report and dovish stances from global central banks, has lifted Brent and WTI 22 percent and 26 percent off their Christmas lows. The overhanging backdrop of these three threats, however, has capped any further advances on crude as these events continue to persist as massive fat-tail risks.

In addition to the fat-tail risks, markets also have to contend with the fact that the global economy is entering its late stage cycle. China is experiencing a slowdown in growth as it attempts to deleverage while notable export-oriented economies in the region, particularly South Korea and Thailand, are all reeling under soft demand worldwide.

"In 1H2019, we expect oil prices to remain subdued due to an overhang of bearish factors, including the bleak economic backdrop and the triple threat of trade tensions, US government shutdown and Brexit," the report commented

"In 2H2019, oil prices could possibly rebound as we expect clearer resolutions on the triple threats and global demand/supply dynamics to balance out," it added.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record