After reaching as high as $12 trillion in 2014, global reserves have been declining ever since, largely thanks to lower oil price coupled with weakness in China and emerging market currencies. China alone last year has shed reserves of $513 billion, but still China may not be the main culprit behind reserve's slide.....oil is.

While oil's slide is seen as boost to oil importing countries, it may not be that good considering ripple effects from lower oil price. Most of the emerging market economies are running a trade deficit, especially the fragile five - India, Brazil, turkey, Indonesia and South Africa. India is one of the largest crude importing countries among these, however in spite of 70% drop in crude oil price, the country is running quite large trade deficit.

India's trade deficit has shrank from $20.1 billion a month in 2013 to just $9.8 billion in last November but still significant dollar inflow is required to plug the gap, similar can be said for others.

In plugging this gap, portfolio investments and foreign direct inflows play crucial role and in portfolio flows SWF (sovereign wealth funds) are major players.

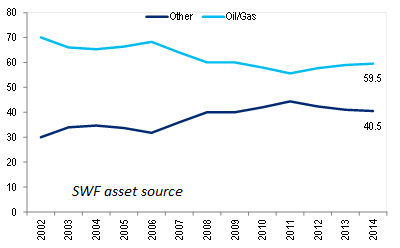

As the figure shows, back in 2003 era about 70% of the SWF assets came from oil/gas sources, now heading into 2014, the role of energy has diminished but still contribute about 60% of the asset source. These SWF assets size run in trillions of Dollars, Norway has largest SWF, with size more than 800 billion, larger than may global economies, and even Saudi Arabia has around $700 billion.

With drop in oil prices by 70%, SWF flows from oil and gas have not only dried but these economies have become net withdrawer of assets.

All in all. We can say an important source of global financing for stocks and bonds are vanishing and fast.