While the OPEC ministers are preparing to meet in their Vienna headquarter on Thursday, the financial market continues to get overwhelmed by the recovery in the US oil production since last July. The shale oil recovery remains one of the biggest threats to the recovery in oil price and to the success of the OPEC and N-OPEC deals.

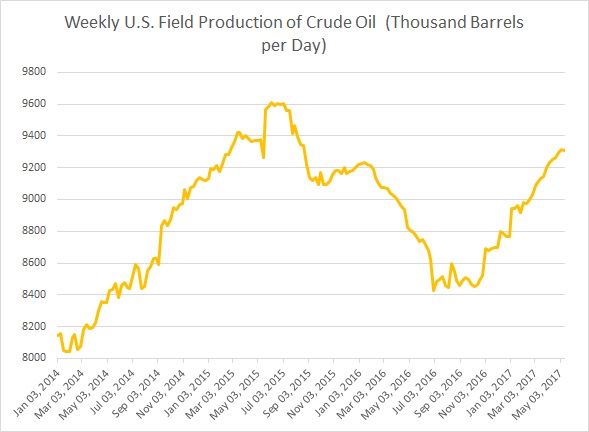

According to latest numbers, the US oil production has reached 9.305 million barrels per day for the week ending on 12th May 2017. The production is up 877,000 barrels per day from its bottom in last July. The current level of production is just 305,000 barrels shy of the all-time high reached back in June 2015. See Chart 1

Similarly, the oil rig count compiled in the Banker Hughes report shows the trend of a sustained recovery. In the face of lower oil price, the numbers of active wells in the United States declined from 1,609 in October 2014 to just 316 in May 2016 and recovered since. The number of active wells have more than doubled in the past 12 months and is currently at 720. The number of active rigs has increased for 18 consecutive weeks. See Chart 2

As the shale producers were able to reduce their breakeven drastically, they are likely to remain as a dominant force in the global oil market not only for months but years to come. It would pay off to keep a tab on the numbers from the United States.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022