The recent and sharp rise in U.S. crude oil production has forced the oil bulls to rethink their position and not to be overoptimistic on the production cuts from the OPEC and some N-OPEC producers, which is expected to cut supply by 1.758 million barrels per day by the first half of 2017.

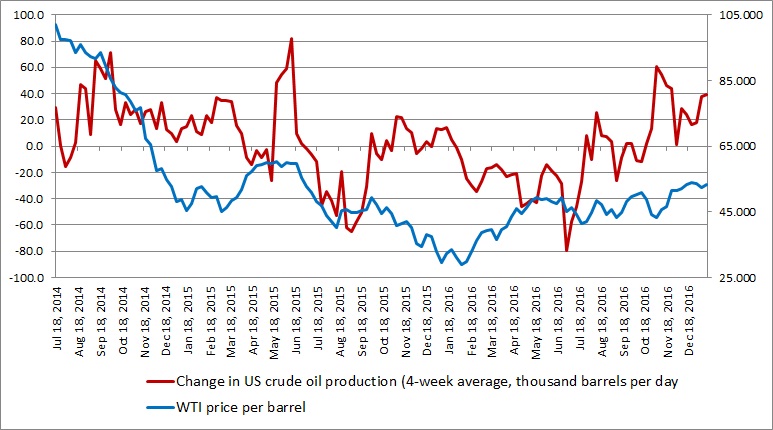

The chart above shows the change in US crude oil production since July 2014 (4-week average) and WTI price per barrel. A close scrutiny tells that the production rose whenever the price of oil increased. Since June last year, the production trend has been clearly upwards. Since mid-October, the production growth hasn’t been below zero. Since the OPEC deal in November, production has increased by 166,000 barrels per day and the average increase has been 24,000 barrels per day per week (4-week average) and since the last dip in production in mid-October below zero, total production has increased by 387,000 barrels per day.

And with a new administration in place in the United States, the production is expected to move higher as the new President Donald Trump has vowed to open up the full potential of US energy by removing regulations. So, in 2017 the price of oil would be determined by the production in the United States rather than the deal by OPEC and N-OPEC countries.

WTI is currently trading at $53 per barrel and Brent at $2.3 per barrel premium.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022