Several prominent OPEC and non-OPEC members, such as Saudi Arabia and Russia will be meeting in Doha, Qatar, to follow up and probably strengthen the ‘production-freeze’ agreed last month on April 17th. While Saudi Arabia, Russia, Qatar and Venezuela have agreed to the freeze, several more are expected to join in next month after the meetings. International Energy Agency (IEA), even recognized the effort and cited it as one of the key elements fuelling recent 50% rise in Crude price.

However, doubts remain, whether or not the current production freeze, which is being agreed between producers controlling, 65% of global production, will be sufficient to pull the oil price further higher. That is due to the following reasons –

- Even with a production freeze, current levels are already around record high. Both Saudi Arabia and Russia are producing well above 10 million barrels each.

- Current global inventory levels are around record high and above 3 billion barrels for OECD countries.

- OPEC and Russia’s actions may not challenge the glut arising from North America.

While we have addressed the first two, we feel biggest of the above is the third one.

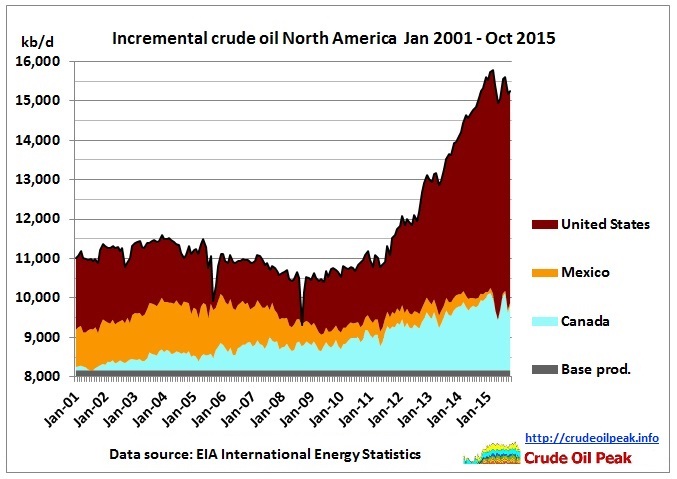

The graph from Crude oil Peak, Why it is the biggest of the issues.

Since after the financial crisis, crude oil production in North America increase by 6.5-7.5 million barrels/day, surpassing the current global oversupply of 2 million barrels by 3-4 times. Moreover, latest figure shows, production hasn’t been affected much, compared to massive drop in prices.

US is producing crude at peak levels of 2014, despite more than 60% drop in number of active oil rigs. With very little state intervention, it would be very difficult to balance production in North America, other than the effects of lower crude price doing the trick. And still a persistent supply glut is indicating that producers in North America becoming more efficient in their production. Cost of producing each barrel may have reached $30-40 area from their $80 level, two-three years back.

In addition to that, latest technological innovation enables the shale producers’ from switching on and off a well at a very marginal cost, which means, production could improve with higher price. So without any coordinated oligopoly among state and private producers, major recovery in oil price seem far-fetched an idea.

Notably, WTI price is down -1.2% today, trading at $39.2/barrel.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed