Saudi Arabia’s banking system likely to suffer liquidity setback as oil price, which despite recent gains, down more than 60% from its peak in summer of 2014. So far Saudi Arabia has withstand oil shock and survived depreciation of its currency, thanks to fixed exchange rate mechanisms, whereas currencies of Venezuela, Russia, and Nigeria suffered major setback.

However, fixed exchange rate regime and relatively high foreign exchange reserve doesn’t ensure no fragility, it according to us makes the country exposed to more internal adjustments and for Saudi Arabia, cracks are clearly emerging, especially in the banking system.

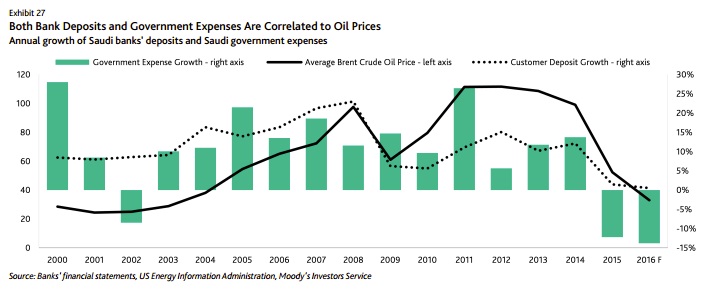

- Government’s share of deposits in Saudi Arabia’s banking system, as of 2014, reached more than 22%, which is quite significant considering the total size of deposits, 1.65 trillion Saudi Arabian Real or $440 billion approximately.

With Saudi Arabia, moving to high budget deficit, post oil crash, as much as 16% projected for this year, if oil remains at current levels, deposit inflow is likely to slow down and government sectors will make net withdrawal.

- Data from 2015, strongly points to this direction. According to calculation by Moody’s, public sector bank deposits dropped by 5.7% in 2015, bringing the net inflow of deposits to just 1% in 2015, which is down 11% from a year back.

Moreover, public sectors unlikely to be the only one, contributing to the banking sectors fragility. As the country try to reign on budget deficit, it will reduce significant portions of public spending, infrastructure spending as well as some welfare cuts, which eventually lead to lower savings rate by private sectors and households.

- Again evidence shows, both government spending as well as growth in bank deposits are highly correlated to oil price. So longer the oil remain down, more acute will be the pain for banks. Data shows, for the first time since 2002, government spending growth has been negative and by more than 10%.

With negative outlook from Moody’s, we expect at least two of the three global credit rating agencies will downgrade Saudi Arabia’s sovereign ratings as well as the banks, if oil fails to recover by at least another 50% from current $40/barrel levels.

Thus in turn likely to weigh over Saudi Arabia’s fixed ERM to Dollar.

Chart courtesy Moody’s.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed