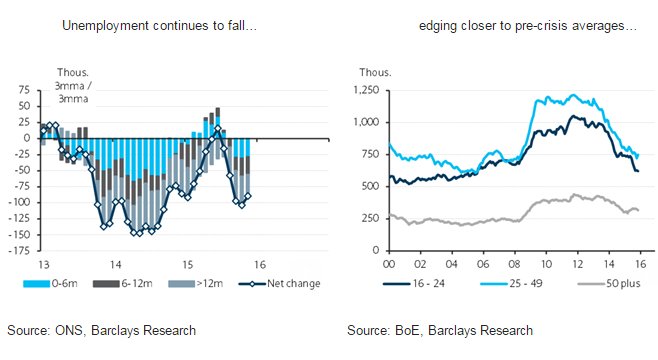

Data released earlier today by the UK Office for National Statistics showed UK jobless rate at a decade low of 5.1% in three months to December, unchanged from the previous month and missing expectations for a reading of 5.0%. More importantly though, wage pressure continue to remain subdued at around 2%. Jobless benefits fell 14,800 to 760,200 in Jan, taking the rate to 2.2%. In Dec, the total dropped 15,200 instead of previously reported figure of -4,300.

The Bank of England has attributed this to temporary factors such as slower productivity growth and the fact that lower-paid roles are making up a "larger-than-usual share of net employment growth". With wage pressures remaining fairly subdued and headline inflation likely to remain low in the near-term, the BoE has room to leave rates unchanged until the Brexit uncertainty subsides.

"Overall, the current environment underscores our view that a hike in Bank Rate will be pushed out to Q4 16. Further, with yesterday's weaker-than-expected CPI print and today's continued weakness in wage growth, it only underscores the cautious comments made by Ian McCafferty, that the pick-up in domestic inflationary pressures is going to be later and slower than the Committee had previously thought." said Barclays Capital in e report.

A mixed labour market data shows continued signs of weakness in wage growth amid further tightening in the labour market. A tighter labour market had been expected to exert upward pressure on pay, but prolonged low inflation is seen as a significant factor in limiting pay awards. The pick-up in earnings growth now looks likely to be gradual in the near term at least. Consumers' expectations have also shifted with a survey of households showing on Wednesday that the number of Britons who expect the BoE to raise interest rates over the next 12 months has fallen to its lowest in more than two years.

"The latest labour market data are likely to solidify expectations that the Bank of England will not be raising interest rates in 2016. In particular, further slippage in earnings growth argues against any interest rate hike for some considerable time to come." said Howard Archer at IHS Global Insight.

The pound which had earlier fallen to as low as 1.4244 against the dollar, dipped after the numbers, but then bounced back to 1.4325. GBP/USD was trading at 1.4314 levels at 1200 GMT.

ONS labour data paints a mixed picture of UK economy, justifies no early rise in UK rates

Wednesday, February 17, 2016 12:04 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary