Beijing has been pushing for the yuan to be included in the IMF's Special Drawing Rights basket as part of its long-term strategic goal of reducing dependence on the dollar. If successful, CNY will become the fifth currency to join the USD, EUR, JPY, and GBP in the SDR basket.

Every five years the IMF reviews the composition of the foreign currencies included in its Special Drawing Rights currency basket. In November it is expected to announce its final decision regarding the SDR valuation review, with a focus on the potential for CNY inclusion in the basket. Many believe the Chinese yuan is set for inclusion this year, thanks to Beijing's concerted lobbying effort and its reforms to the country's foreign exchange market and exchange rate mechanism.

IMF earlier today announced that no date had been set for reviewing whether to include the Chinese yuan in its reserve currency basket, responding to a report in local media that the review would be delayed. China Business News, a respected domestic finance newspaper, had said on its website that the IMF was pushing back its plan to make a decision from Nov. 4 to Nov. 30.

"We will certainly convene a meeting sometime in November, but we do not have a specific set date yet," IMF official in Beijing said.

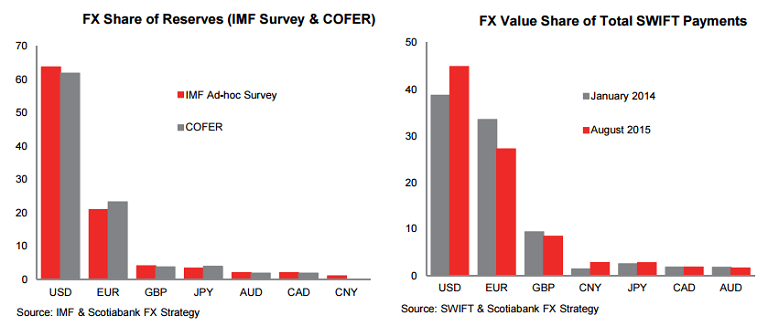

China has opened its inter-bank bond market and forex market to overseas financial institutions and has been promoting data transparency. At the same time, the internationalization of the RMB has been making progress, with the Yuan becoming the 4th most-used world payment currency in August. IMF survey data for 2014 showed that 38 of 130 members hold CNY reserves, accounting for 1.1% of global reserve holdings (up from 0.7% in 2013). The USD accounts for 63.7%, the EUR 21%, the GBP 4.1% and the JPY 3.4%.

CNY inclusion in the SDR basket is likely to have limited near-term impact on the value of the currency-or on the value of other major currencies. A negative outcome from the meeting might add further depreciation pressure on the yuan, complicating Beijing's attempts to hold the currency stable without draining its foreign exchange reserves too rapidly.

"We remain biased to CNY weakness on the basis of capital outflows within the context of liberalization, and see risk of decline into year-end", says Scotiabank.

In the spot market CNY was trading at 6.3360 per dollar at market close, practically flat with the previous day's trade. The offshore yuan softened by 0.9 percent to 6.3501 at the time of writing.

No specific date for IMF's yuan SDR review, CNY likely to see minimal near-term impact

Wednesday, November 4, 2015 11:06 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings