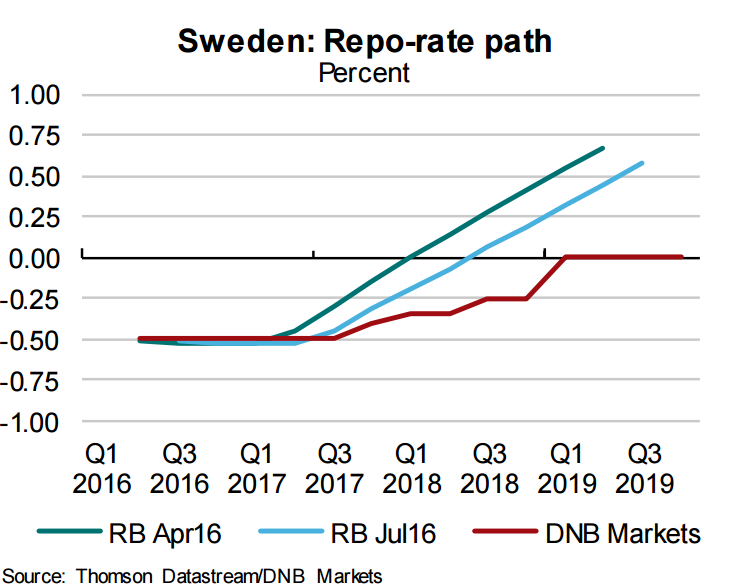

Sweden's central bank left its benchmark repo rate unchanged at -0.50 pct at its July 6th meeting and said it was ready to make monetary policy more expansionary if the inflation prospects deteriorate. The asset purchases were also kept unchanged, while the rate path was lowered in 2018 and 2019 and negative bias this year and the next were pursued.

Trade-weighted krona has weakened, partly as a result of the UK vote to leave the European Union and is helping the central bank in its struggle to spark inflation. Headline inflation is edging toward the Riksbank’s 2 percent target while underlying inflation, the focus of attention at the central bank, is at 1.4 percent. Meanwhile, trend-adjusted unemployment has fallen to its lowest level in almost eight years, adding to inflationary pressures.

Growth in the Swedish economy remains strong, although abating. The labour market still shows improvement, with high employment growth and a gradual reduction in the unemployment rate. Sweden’s central bank will likely hold off from adding more to its record stimulus at its policy meeting on Sept 7th. The Riksbank will want to keep some ammunition stocked in its arsenal for a rainy day.

"We expect Riksbanken to announce that the policy rate is held unchanged on Wednesday morning. We expect small changes in interest rate path and the asset purchases to be kept at today’s level of total SEK 245bn," said DNB Bank in a report.

As inflation picks up further, Riksbank will gradually become more relaxed about the value of the SEK and to a larger extent again emphasize their financial stability concerns. Riksbank's unprecedented efforts to boost inflation have revolved around avoiding excessive currency strength that could be the outcome from the European Central Bank’s stimulus. Rising inflation could now hand policymakers leeway to tweak the inflation regime.

In a speech in April, central bank governor Stefan Ingves opened up for a change in the inflation gauge the bank aims for, saying that the bank would complete a review of whether to reintroduce the tolerance band within 6-12 months. In July, Ingves argued that it’s impossible to exactly adhere to a 2 percent target and that it’s “perfectly sufficient” to be near the goal.

There’s growing speculation Sweden’s central bank will reintroduce an interval for its inflation target as well as change its price index. The change may pave the way for it to start rolling back the record stimulus. However, Anna Breman, chief economist at Swedbank, said that it would be ill-timed by the bank to go back to an interval now because it would damage credibility in the target and be perceived as a signal of a tighter monetary policy, which would drive the krona higher.

EUR/SEK trades 0.1 percent lower on the day, at 9.5326 at around 11:00 GMT. Technical studies are biased lower with a shooting star formation evidenced on daily charts on Sept 9th. Downside finds strong support at 9.4882, violation there could target 9.4383 levels. USD/SEK was also 0.27 percent lower on the day at 8.5382.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist