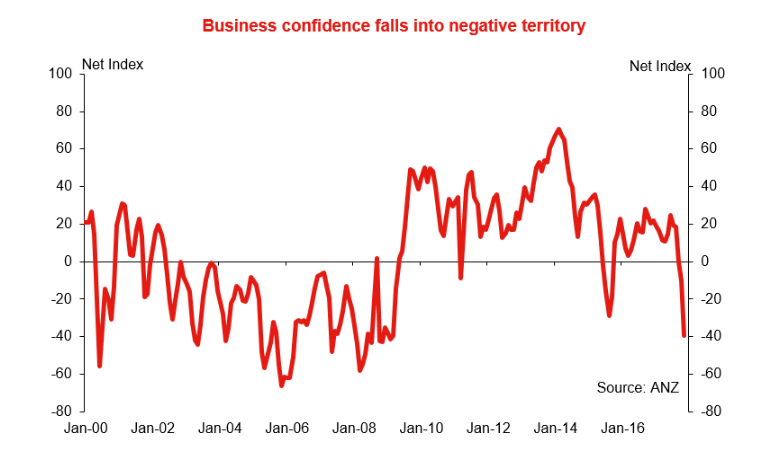

New Zealand business confidence fell to its lowest level in eight years in October, in the first survey results after the formation of a new coalition government. The uncertainty around changing government policy, a softer housing market, and difficulty getting credit seen as likely causes. The kiwi weakened across the board and NZ swaps fell by 1 basis point in reaction to the survey.

Data from Australia and New Zealand Banking group released Thursday showed a net 39.3 percent of firms expect the economy to deteriorate in the next 12 months, down from 10.1 percent in October and the lowest reading since March 2009. A net 6.5 percent of companies see their own activity expanding, compared to a net 22 percent a month earlier. 12.5 percent of firms expect profit to fall in the year ahead, from 11.7 percent expecting profit growth in October. Employment intentions dropped to a net negative 3 percent from 14 percent positive the prior month.

“We haven’t seen a reading like this since we were clawing our way out of the financial crisis in 2009,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “The key question is whether this is just a knee-jerk reaction to the new government or is there going to be a longer lasting period of nervousness among businesses.” he added.

The survey results were compiled before the Labour party formed a coalition government with the New Zealand First party. However, responses were received only after the final government make-up was decided. Hence the downfall cannot be wholly attributed to the change of Government. A frothy housing market is one of the biggest risks for the New Zealand economy which along with tighter lending conditions also having a major contribution.

"We forecast a hiatus of business investment in 2018, a key reason for lowering our forecast of economic growth in 2018. We stand in stark contrast to the RBNZ on this front, as the RBNZ is anticipating strong growth next year. Today’s plunge in business confidence supports the idea that business investment may stall." said Westpac in a research note.

The NZD/USD down 0.65% on the day, as the bird was dented by dismal NZ business confidence data. Upbeat U.S. Q3 GDP and Fed Chair Janet Yellen's testimony provided an additional boost to USD weighing further on the pair. Technical studies are bearish, upside remains capped at 20-DMA. We see scope for test of 61.8% Fib at 0.68 ahead of 0.6760 (trendline).

FxWirePro's Currency Strength Index also supports downside in the pair. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand