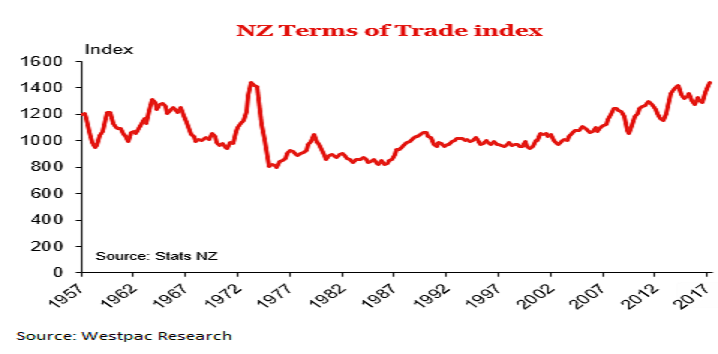

New Zealand’s terms of trade rose during the second quarter of this year, albeit at a slower rate, supported by a rise in export prices, especially that of meat and dairy products. In addition, the terms of trade fell slightly short of the record high that markets were anticipating.

The country’s Q2 terms of trade rose 1.5 percent in the June quarter, a bit less than what markets had expected. In addition, the March quarter increase was marked down from 5.1 percent to 3.9 percent, due to a revision to the price/volume split for forestry exports.

Export prices rose by 2.4 percent, led by a 9 percent rise in meat prices and a 4 percent rise in dairy prices. Most export commodities performed well over the quarter, with the exception of a 3 percent drop in wool prices. Manufactured goods prices were down 2 percent, although that followed a 6 percent jump last quarter.

Import prices rose by 0.9 percent. Petroleum prices fell by 4 percent, but there were price gains across a range of manufactured goods. A slightly lower exchange rate over the quarter will have contributed to higher import prices.

Further, export volumes rose 6.8 percent in the quarter, reversing much of the 8.4 percent cumulative decline over the previous three-quarters. Dairy export volumes rebounded by 19 percent, reflecting both an improvement in milk production over the first half of this year and the delayed timing of some export shipments. Import volumes rose 2.3 percent, largely due to a lumpy quarter for petroleum imports, which are up 18.5 percent.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data