National Bank of Poland (NBH) is meeting next week to decide monetary policy and markets expect the event to be largely uneventful. The NBH held rates at its January meet and also flagged a continuance of non-conventional measures that is has used to fine tune monetary conditions. Governor Adam Glapinski said that Poland may leave interest rates at 1.5 percent for up to two more years if the economy does not pick up.

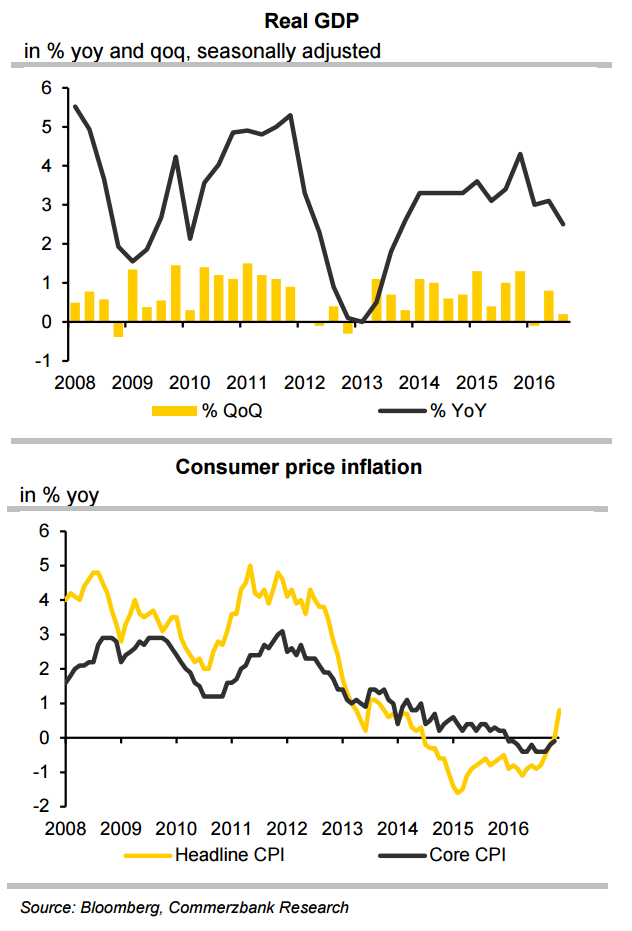

Poland published first estimate of GDP for 2016 earlier this week, which showed output up by stronger-than-expected 2.8 percent. Although 2016 growth was much weaker than the 3.9 percent of 2015, the data implied that Q4 2016 had witnessed sharp quarter-on-quarter GDP increase of around 1.8 percent. This came as a surprise especially because policymakers had recently remarked that the economy did not noticeably picture up in Q4.

Polish inflation has risen sharply from zero to 0.8 percent year-on-year between November and December. Poland’s inflation, as in the case of the euro area, is being accelerated mainly by energy prices. MPC member Zubelewicz expects Poland's year-on-year rise in CPI to reach 1.5 percent by mid-year. Economists expect economic growth to pick up too from the 2.5 percent posted in the third quarter.

"Data are zloty-supportive. Stronger GDP growth, in combination with accelerating inflation, will give further strength to the hawks on the MPC who are increasingly asserting their views and referring to the possible timeframe for rate hikes. This is a big change from the deflation-fighting days of 2016." notes Commerzbank in a report.

The bank has kept rates at 1.5 percent for 22 months as inflation has held well below its 2.5 percent target, also giving itself leeway for further cuts in case of external economic shocks. Despite signs of pickup in headline inflation rate, core inflation remains close to zero. We expect the NBH to hold rates at Feb policy meet. "We expect no hawkish signals in the first half of this year," said Nordea Bank in a report.

EUR/PLN was trading at 4.2975 at around 1215 GMT, down 0.44 percent on the day. Downtrend in the pair intact. FxWirePro's Hourly EUR Spot Index was at -63.8342 (Bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary