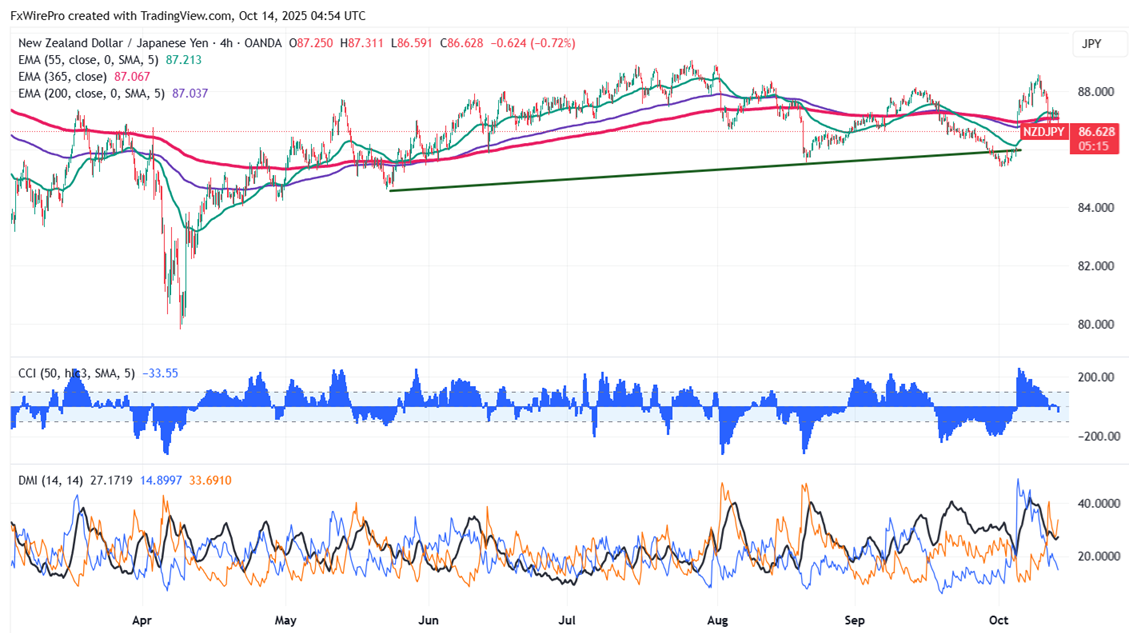

NZDJPY trimmed some of its profits as the yen rebounded. The intraday trend is downward as long as 87.50 serves as resistance. Having attained an intraday low of 86.61, it currently trades around 86.62. Should pair trade below 89.20, the overall trend is still soft..

Oscillators and moving averages to forecast the trend of NZDJPY

CMP- 86.65

EMA (4-hour chart)

55-EMA- 87.06

200-EMA- 87.03

365-EMA- 87.05. The pair trades below the short and long-term moving averages.

Major support- 86.40. Any breach below will drag the pair down to 86/85.37.

Major resistance - 87.50. Any break above 87.50 confirms minor bullishness, a jump to 88.10/88.50/89.25.

Indicator (4-hour chart)

CCI (50)- Neutral

Average directional movement Index- Bearish. All indicators confirm a mixed trend.

It is good to sell on rallies around 87 with SL around 87.50 for TP of 86/85.38.

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure  NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back

NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm

EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm  Major European Indices

Major European Indices  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  FxWirePro- Major European Indices

FxWirePro- Major European Indices  EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187

EURJPY Breaks Above 184 – Euro Bulls Charge Toward 187  FxWirePro: GBP/AUD dips ahead of pivotal RBA call

FxWirePro: GBP/AUD dips ahead of pivotal RBA call  EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182

EUR/JPY Stuck in Neutral Gear — Bulls Still in Control Above 182  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary