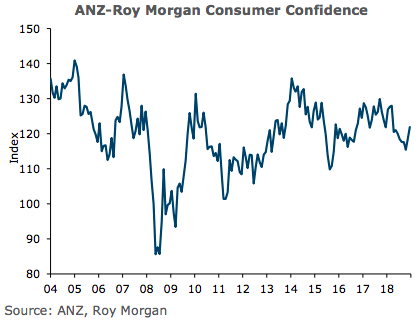

New Zealand’s ANZ-Roy Morgan consumer confidence index for the month of December registered 7 points off its October low. The overall index rose 3 points in December and sits a little above the historical average.

The Current Conditions index lifted 3 points to 124 while the Future Conditions Index rose 4 points to 121. Consumers’ perceptions of their current financial situation lifted 1 point to a net 11 percent feeling financially better off than a year ago.

A net 30 percent of consumers expect to be better off financially this time next year, up 4 points. Also a net 36 percent think it’s a good time to buy a major household item, up 4 points. Perceptions regarding the next year’s economic outlook lifted 7 points to a net 14 percent expecting conditions to improve, the highest since March.

The five-year outlook was unchanged at +18 percent. The improvement was driven out of Wellington, up 10 points, and Canterbury, up 9 points. Wellington has reclaimed top spot at 129. House price inflation expectations were unchanged around the country (2.9 percent), though they fell 1.1 percentage points in Auckland.

They are weakest in Auckland (1.8 percent) and strongest in Other South Island (4.5 percent). Inflation expectations lifted 0.8 percentage point to 4.2 percent. This series is volatile, but it’s notable that this is the highest read since 2012.

"However, falling petrol prices mean the lift is unlikely to be sustained. Consumers are feeling pretty good as Christmas approaches, with confidence lifting again to sit a bit above historically average levels. The proportion thinking it is a good time to buy a major household item bodes well for spending in the lead-in to Christmas," ANZ Research commented in its report.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm