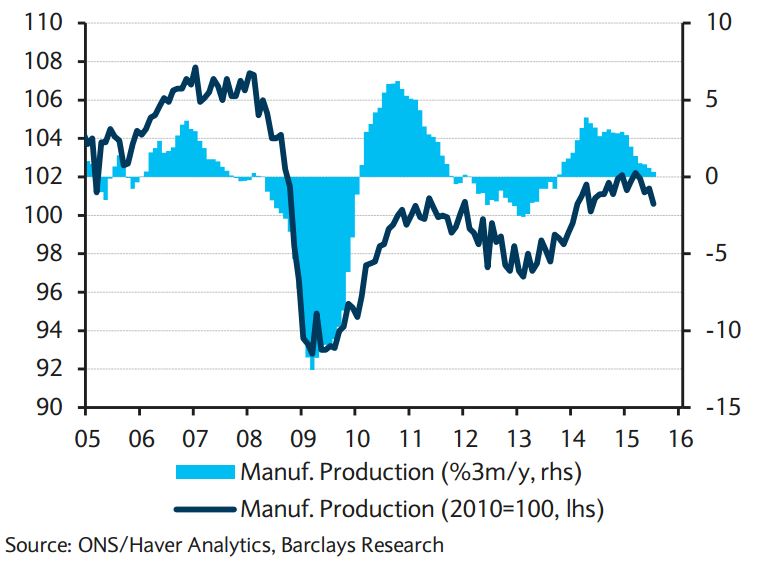

UK industrial production fell for the second consecutive month (-0.4% m/m, 0.8% y/y in July after -0.4% m/m, 1.5% y/y in June), while manufacturing registered a significant downward surprise (-0.8% m/m, -0.5% y/y in July after 0.2% m/m, 0.5% y/y in July). This weaker-than-expected print was echoed by the EEF Q3 Outlook Report in which the EEF, the manufacturing representative body, more than halved its manufacturing growth forecast; at the start of the year it was at 1.7% for 2015 whereas now it is at 0.7%. Of particular concern is the significant drop in investment goods, which has begun to show trend weakness, and the potential spill over this would have on economic activity if weakness continues. The carry over for production in Q3 is now at -0.6% q/q, its weakest since Q4 12.

International trade also showed substantial downside in July, with exports falling 9.5% m/m in real terms, cancelling out a strong second quarter; particular declines were noted in consumer goods and passenger cars. Geographically, weakness came from exports to non-EU countries, falling 15.1% m/m, while EU exports contracted by only 3.7% m/m.

The BoE kept its policy stance broadly unchanged and the balance of voting remained at 8 against 1 in favour of the status quo. The minutes of the meeting were fairly balanced, according to Barclays, with the MPC highlighting that it was still too early to draw conclusions from the latest developments in China and their possible impact on the UK economy. That said, the reference to a "finely balanced decision" for some members has been dropped, highlighting that at the margin, the Bank shifted to a slightly more dovish stance.

The discussion relating to the impact of recent market turmoil and Chinese growth transition confirmed initial thoughts that it would not change the BoE's policy rate strategy, for now. The committee nonetheless acknowledged that it was monitoring the situation closely. In contrast, the domestic outlook was a reason to cheer for the MPC. For Ian McCafferty, this was actually reason enough to vote for a rate hike again. The Bank builds its optimism on the latest Q2 GDP release, the strengthening outlook for household income and the still high levels of confidence, albeit the BoE downgraded its Q3 growth forecast from 0.7% q/q to 0.6% q/q. Even if the most recent data and surveys came in on the soft side, the Bank believes that the message from the August Inflation Report still holds and that levels of activity will remain elevated despite headwinds from the global economy and fiscal consolidation.

"We believe that Minutes were overall fairly balanced but at the margin, the language was more dovish, in particular with the removal of the reference that for some members the decision was finely balanced. While this view could be restored quickly, if the situation and the data were to surprise on the upside, it has to be assessed against the background of other central banks also becoming more cautious. Hence, it make sense for the MPC to become slightly more dovish, if only to limit the upwards pressure on the currency," commented Barclays.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook