A question that is perennially asked by financial experts is: “can the government (in other words, the taxpayer) afford to keep increasing pensions?” But in my view, the real question should be: “what is the purpose of the state pension?”

This isn’t an economics question, it’s a moral question. And, as a society, we are poor at discussing moral questions.

A report from the Office for Budget Responsibility earlier this year stated that in the current financial year, the state pension will cost around £124 billion. This is more than the £105 billion education budget and more than double the £52 billion defence budget.

The level of the UK pension is safeguarded by the triple lock, which was first introduced in the June 2010 budget. It means annual increases in payments are made in line with earnings growth, price inflation (currently 4.6%) or 2.5% – whichever is highest.

With another triple lock increase of 8.5% in pensions due in April 2024, the state pension will rise to £221.75 per week (£11,531 per annum). This is only £20 per week less than the personal allowance everyone can earn before having to pay tax or national insurance.

Assuming wages exceed inflation and 2.5% in line with the last five year averages, then the pension up-ratings could be in the region of 5% in 2025 and 2026. This will see pensioners, who have no other income, having to pay tax – in some cases, a decade after they last paid income tax.

So, how do we ensure that retired people are able to have a comfortable standard of living once they stop working? As a starting point, we can consider principle 15 of the European pillar of social rights, which was set out in 2017 by the European Union and maintains: “The right of workers and the self-employed to a pension commensurate with contributions and ensuring an adequate income. The right to equal opportunities to acquire pension rights for both women and men. The right to resources that ensure living in dignity in old age.”

Comparing incomes

The national living wage is two thirds of UK average earnings and should be the minimum to cover “adequate income” and “dignity in old age”. The salary obtained by an adult working 37 hours per week at the national living wage is currently £10.42 per hour. This will increase to £11.44 per hour from April 2024.

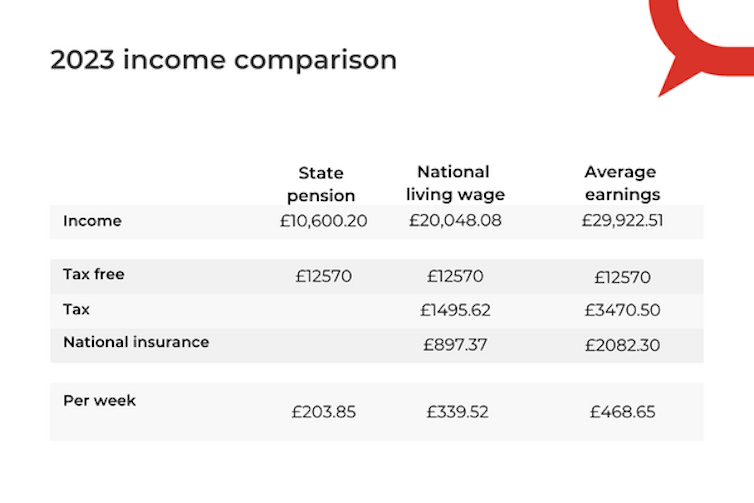

A comparison of the state pension, national living wage and average earnings in the UK in 2023.

Were the UK pension matched with the national living wage, it would be set at a figure of £22,308 per year, and pensioners’ income would be vastly different as of April 6 2024.

Even after paying more than £1,900 in tax, the poorest pensioner would be still be £225.15 per week better off than they are today. And the extra disposable income could be recycled into the economy through increased expenditure, with knock-on impacts in indirect taxes such as VAT.

A European comparison

A recent survey by pension advice firm Almond Finance UK shows the UK is currently 16th out of 50 countries in terms of the best pension offering across Europe. Spain tops the survey, with Belgium in second place and Luxembourg third.

Bringing the state pension in line with the national living wage would move the UK up to fourth position, ahead of Bosnia and Herzegovina, Cyprus, Lichenstein, France, Denmark and Switzerland.

Such an increase would raise the annual cost to the Treasury from the current £124 billion to £236 billion. And such a large increase in expenditure would require more taxes or more borrowing, which would accrue more debt interest in turn. But this sum could be reduced by £13 billion by charging pensioners national insurance.

In a response to an online petition in August, which called for the state pension to be matched to the national living wage, the government said it had “no plans to increase the state pension to equal 35 hours a week at the national living wage”. It went on to describe the state pension and national living wage as having “different purposes” and said that a direct comparison could not be drawn between the two.

With the focus on cutting both business rates and national insurance in the autumn statement, it’s worth considering how those measures will help to ensure that pensioners live in dignity in old age.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure