After the outcome of the recent UK referendum a period of heightened uncertainty is expected to prevail in the coming weeks, possibly months. European leaders appear to want to move forward with Brexit plans as quickly as possible, but political turmoil within Britain suggests a quick turnaround is unlikely. UK Labour leader Jeremy Corbyn lost a no-confidence vote on Tuesday by 172 votes to 40. The political implosion has rendered both UK's main parties effectively leaderless at a time when the country is under pressure to make fundamental decisions.

The US is certainly not immune to the impact of Brexit. Short term impact on the US economy could be through two main channels: a direct impact via weaker external demand; and, financial and confidence effects. Fed Chair Janet Yellen had in a statement after June FOMC meeting said that Brexit could have consequences for global economic and financial markets. She added that if this was indeed the case, then it would be a factor when deciding the appropriate policy path.

Analysts expect a sharp slowing in the UK economy, a recession is also not ruled out. However, this is unlikely to have much impact on US GDP since UK has small trade linkages with the US. The largest impact will be by a tightening in financial conditions. All major central banks have assured that they stand ready to do whatever is necessary to contain volatility, support confidence and protect the real economy. Turmoil in financial markets is only likely to add to the Fed’s predisposition to caution and will keep them on the sidelines for longer.

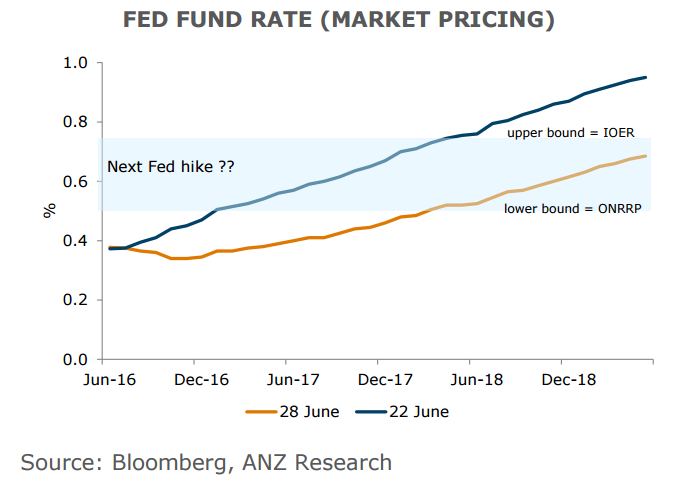

The market has sharply recalibrated its expectations in the wake of Brexit and is currently factoring in marginal cuts to the fed funds rate in the short term, while a hike is not priced in until 2018. On a fundamental side, US economic momentum appears to be good and inflation is on a gradual upward trajectory. Should financial conditions ease and greater certainty emerges on UK's exit (or not) strategy, the Fed could be on track to normalise rates later in the year.

"We now just expect one rate hike towards the end of 2016. Previously we had anticipated two. We expect a further two hikes in 2017 in Q2 and Q4," said ANZ research in a report.

The US Dollar index DXY was lower for a second day after reaching peaks of 96.71 on June 27th. DXY was at 95.85 at around 1215 GMT. EUR/USD was at 1.1095 while USD/JPY was at 102.68.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook