FOMC meets next week, and it is now more than certain that the Fed will rates from near zero, with probabilities around 85%, which is as close as the market can price it ahead of the meeting. Attention now is moving away from liftoff and more towards the shallow path of hikes expected thereafter. Fed officials have made clear they are comfortable the employment part of their dual mandate is met, the pace of future rate increases will depend on inflation rising.

"Of analysts 60/72 expect the same (could be higher as it has not been updated after the November jobs report). This is also in line with the latest FOMC projection from September and recent FOMC members' communication", says Danske Bank in a research note.

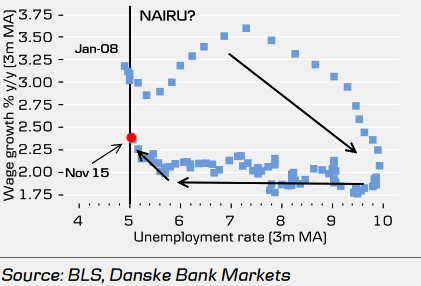

The labour market is key to understanding why the Fed wants to begin hiking cycle. Lets break down "long-run Phillips curve" to understand, and begin by comparing the US and UK labour markets. In UK, wage growth can be subdued for a long time and suddenly increase very quickly when the unemployment rate reaches the NAIRU. Whereas wage growth in the US, as measured by average hourly earnings, has already begun to show the same signs as illustrated in the chart above.

US PCE core inflation is still subdued and below the FOMC's 2% target (1.3% y/y in October). The Fed expects the tightening in the labour market to continue, and hence wage growth to increase going forward. The increasing wage inflation means that the underlying inflation pressure in the US will rise. The Fed is likely looking beyond temporary headwinds from lower commodity prices and the strong USD, and intends to act now as changes to monetary policy work with an approximate two-year lag.

"The Fed will continue to target a range for the Fed funds rate. The interest rate on excess reserves (IOER) will be set at the top of that range and the overnight reverse repurchase agreements (ON RRP) rate will be set 25bp below that rate (currently 20bp below). A 25bp rise implies that the IOER and the ON RRP will be set at 0.50% and 0.25%, respectively", adds Danske Bank.

USD/JPY posted a modest recovery from an almost 200 pips slump in Wednesday's trade and is currently at 121.65 as at 1109 GMT. While EUR/USD was trading at 1.0945, edging lower from session highs at 1.1025.

Markets agree on Fed hike next week, labor market key to understand tightening bias

Thursday, December 10, 2015 11:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty